- High Yield Harry's Newsletter

- Posts

- Revealing my Thoughts on Finance Newsletters

Revealing my Thoughts on Finance Newsletters

Analyzing the Finance Newsletter Industry

Together with Cognitive Credit

With 2Q25 reporting complete, now is the time to update your views with the latest numbers. You could spend hours doing that manually, or you could access an up-to-date credit model for over 2,600+ High Yield and Investment Grade bond issuers in the US and Europe, on demand via Cognitive Credit.

As a special offer, request a model for any name in our High Yield or Investment Grade coverage, and we’ll send you the very latest numbers – structured and validated by our technology – in a ready-to-use spreadsheet model.

Why use our data?

● All data is sourced from official earnings reports and presentations

● Extracted accurately and automatically by machine-reading technology

● Validated algorithmically against accounting and financial relationships

● Verified by our analyst team to ensure unparalleled data integrity

● Updated models delivered within 15 minutes of earnings release

Cognitive Credit is the market's premier provider of fundamental credit data and analytics for credit investors. To see how we could transform your credit analysis workflow, request your demo today.

Welcome Back!

I have a confession - I’m a bit of a nerd and marrying my experience in finance with building a rapidly growing internet media company has given me a unique perspective to the newsletter industry. So I’d love to talk about an industry I’m passionate about, and even if this newsletter vertical post is less for you, you can at least learn a bit more about what I’m up to or apply it to how you approach investing in other categories. In this, I’m mainly referring to the surprisingly large and fragmented “Morning Brew for Finance” category.

FYI - we’ll have a restructuring deep dive out in mid September.

While I’m not showing my full hand, I’m going to be somewhat of a shockingly open book in this.

Two NYC-Based Private Credit Roles:

Hey guys, real quick, we have two private credit searches we’re helping with - apply exclusively on Buyside Hub.

Credit Analyst at Tree Line Capital Partners: This NYC based role is best suited for someone with at least 1 year of experience in investment or commercial banking, accounting, or consulting. This is a great opportunity for someone from a non-traditional background to get into Credit.

Investor Relations at Tree Line Capital Partners: This NYC based role may be an Analyst, Associate, or Senior Associate role depending on experience.

In December 2023, I closed on a deal to acquire the brand known as Wall Street Gossip. After acquiring it, I wanted to think about ways to leverage it into other media properties.

I was at a bit of standstill with the High Yield Harry Newsletter. It was at at around 15,000 subscribers and was seeing comparable meme pages absolutely rocket ship up to 200-250k subs. Some of that was due to scale, but also due to paid growth. On another end of the spectrum, there were paid newsletter writers like Edwin Dorsey who were building an impressive business. And then on another side it felt a lot of other writers, both great and mediocre were falling into a lot of money.

My initial foray into newsletters was from seeing people back in 2021 and 2022 have massive success in the space. I’d ask what they’d charge and I’d hear back smaller newsletters generating a whopping $500 or $1,000 or $1,500 per placement. This compared to me making $200-$300 on Instagram Advertisements at the time. I was blown away by this but at the time was still a little too junior and green to understand that this was a bubble that was about to rationalize. Those advertising placements and sponsors quickly dried up and 2021 was an euphoric period for newsletters.

But before I move on, the desire to have a general newsletter seemed like a no brainer. Not everyone cared about Credit markets. And the 2x/week newsletter model was awesome from a volume standpoint - it meant there was always money coming in the door and placement availability!

High Yield Harry’s Newsletter:

Write about the Credit markets and provide career resources I used to land multiple seats in public and private credit.

Write about investing trends and frameworks I find interesting and applicable

Write up restructuring oriented content (a newer initiative, which makes sense given I’ve written a lot about credit careers already and at some point will be leaving credit to do HYH full time)

Be able to communicate with you all, whether it’s to talk about Buyside Hub or other things I’m working on or thinking about

The Wall Street Rollup:

Help time-crunched readers catch up on what they need to know without any click-bait noise

Our writing style gears towards telling people what happened in two to three sentences, as opposed to being too lengthy or being clickbait

Care more than everyone else - don’t just phone it in - strive to be the best

Regarding the point above, there’s so much I would love to write about how dialed into the market and obsessed I am with providing you guys great and reliable content - but for the sake of going even further beyond 6k words we’ll just focus on the “economics” side of newsletters

This includes 1) earnings updates 2) very quick and relevant headlines for IB, PE, and Finance professionals, and 3) M&A transaction news and comps

This is a new initiative - but publish “buy” and “sell” stock ideas so rushed professionals can get ideas sent right to their inbox. I want to provide our readers with high quality ideas (I could use this myself as I’ve grown increasingly stretched for time) but to also compete against complacent incumbents. The hope is this paid vertical “pays for itself”, although past performance isn’t indicative of future results. Basically, we have institutional level professionals helping out on the side.

Collectively, these are pretty sizable businesses if executed correctly, and most importantly it provides a way to communicate with everyone beyond just the whims of social media algorithms. Ultimately, my goal is to slowly transition my time away from Instagram over the next few years anyways.

However, these ideas, and any finance category is highly competitive - making executing hard.

Growing the Wall Street Rollup:

In April 2024, we announced the acquisition and launch of The Wall Street Rollup, a 2x/Week Finance, Markets, and Investing Newsletter that you can digest within a few minutes. Similar to PE roll-up strategies, the Wall Street Rollup is a platform that makes smaller, accretive tuck-in acquisitions (in addition to its core focus of having very detailed newsletters).

Consolidation update: Over the past 17 months, I’ve completed four deal tuck-in deals at accretive multiples and reasonable payback periods. I have a very methodical approach to valuing newsletters, and passed and lost out on stuff that would’ve been dead money. Over time, this newsletter grew from 13k subs to 20k, to 45k, to 60k, to now 80k following smart investment. More details on that in a bit.

Where it stands today: We’ve priced the ad rates of our newsletter lower than others to drive volume and make sure we’re able to drive conversion for advertising partners. After initially struggling to do so in the <45k range, we’ve really executed on this front at the 80k readers level.

Key Definitions:

Before we get into it, I want to define a few things.

CPM: Cost-Per-Mille. What is my cost for reaching 1,000 people? If I pay $5 to reach 1,000 people, I have a $5 CPM.

CPC: Cost-Per-Click. What is my cost every time people click on stuff? If it’s $2 and 50 people click on it, then I spent $100.

CPL: Cost-Per-Lead. This is generally not as compelling for creators unless very lucrative. Time and time again, creators will favor fixed-rate or the other two-performance-based rates rather than actual conversion. Why would a creator do this? Also space is finite - with finite slots, this and CPC is much less compelling than receiving guaranteed compensation for your time and space.

CPA or CAC: Cost-Per-Acquisition or Customer-Acquisition-Cost.

LTV: Life-Time-Value. The Net profit generated from the average subscriber

Open Rates: The percentage of people who received the email who opened the email.

CTR: Click-Through-Rate. The percentage of people who click on a link.

B2C: Business-To-Consumer

B2B: Business-To-Business

When you’re advertising you need to think about the CPM price of doing business.

The reality is newsletters either need to be priced as follows:

1) I have a very expensive product and/or a deep budget. I’m a B2B company. I can’t really use cheaper advertising channels because I need to get in front of this very sophisticated or targeted audience and I have to pay up to do so. Maybe I’m selling specifically to CFOs or to C-Suite executives. Additionally, I may be spending $2,000 or $5,000 but if I get one new client to sign up for $50,000 to $80,000 a year then this was a smashing success. It’s a success if it takes me $15,000-$50,000 of spend to land one client. My CPMs are in the 100-300 range as a result. Maybe 50-100 if my product is a lower price point.

2) I can advertise on Meta or Google ads if I want. I’m a B2C company (for the most part). But I need to pay a bit of a premium to find more targeted folks. My CPMs are in the 15-50 range as a result.

You have to be amenable to both types of groups, while understanding that a company in group 1 is not under any circumstances allowed to fall into the lower end of group 2. The only exception would be if there are several competitors who are delivering results for them and pushing them into a lower CPM tier. If so, good for them. But bad for you of course. What you should realistically be doing is trying to do the math on your end and thinking about what type of return the advertiser you’re working with is getting. However re: point 2- you shouldn’t price CPMs too low for folks who want a lot of volume - if they want a lot of volume it means there’s room to go higher!

I think CPMs compressing is the biggest risk and has already happened from 2021 to 2025. On the flip side, I’ve seen some newer, sub-scale creators think a 150-300 CPM ecosystem is going to be there for them and be sustainable at scale…that is very rarely the case and I wish them the best of luck.

Unfortunately, too many publishers operate in a snow globe, essentially they don’t think about ease of replacement and forget they operate in a very fluid competitive environment. Part of my regular thinking re: advertising is can this person go to “Competitor A or B” and get a better outcome than the solution I would provide them? If the answer is yes, then I’m mispriced or disadvantaged.

It is impossible to have a 100% hit rate, let alone a 90% hit rate, but I’m pretty proud about broadly being to deliver from a Sponsorship standpoint - if you want to advertise across any mediums, such as TheWallStreetRollup.com - please shoot over an email.

Constant Change in News: More historical, educational, or career oriented newsletters have a lower shelf-life. Unfortunately, for the HYH Newsletter I’ve written about the bulk of the career oriented content that can be written, so the content is going to change over time to talk about the latest in Credit & recent restructurings.

Reaching your Community: Emails are a very direct way to reach people, this is crucial for me.

Benefits of Scale: If a newsletter takes 10 hours no matter how much you make, there’s obvious benefits to making more $ and writing to more people.

Variable Cost Structure: This comes with caveats though and I actually argue Newsletters are much more capital intensive than people think. But if you stopped investing in paid growth, then you have very high margins (but then your business would start decaying).

The world will continue to get more digital: There’s still a very large migration away from print. This means more advertisers heading to the newsletter ecosystem and more eyeballs heading here too. It still feels early innings in the space, even though there really isn’t a need for too many more newsletters.

Trends and Risks in the space:

It’s never been easier to make a newsletter, so it’s never been harder to monetize a newsletter. Here’s why you can get very bearish on the space quite quickly.

What beehiiv has done to the industry: I’m a very, very small investor in beehiiv’s Series B round. Thank god beehiiv is investing on the enterprise side, because I have concerns on the sustainability of the consumer side. I really respect those guys, it’s just what I think regarding the TAM and shakiness of the consumer/creator newsletter ecosystem. beehiiv has made it very easy for anyone to have a massive toolkit to start and grow a newsletter. There’s been a massive increase in newsletters, whether it’s as a hobby or to try to be the next big thing.

beehiiv has launched an an ad market, as well as a place to receive inbound partnerships. The ad market includes companies that will pay you $1-$3 CPC or $4-$8 CPM. You have deals sent to you and save a ton of time! The problem is, compared to what the typical newsletter sells ads at, you might be running something at 75%+ lower than your usual pricing. Look, I’ll be honest, I’m scanning a fuck ton of other finance newsletters seeing who is advertising and as of late I see the same $4.5 CPM ad deal below in almost every one. That is not sustainable. The biggest issue here is if their ad market truly succeeds, then it comes at the expense of their customers. If all your advertisers are suddenly on an ad network, running at 50%-80% of the cost then this is massive loss of revenue stream. If newsletter ads become “billboard” or “banner ad” like, then there’s a massive push towards lower CPM, programmatic placements.

An example Ad Network Placement (although I believe this is up to $6 CPM now)

^The amount of times I’ve seen this ad placed over the last couple of weeks on sub-scale newsletters I monitor shows that those operators can’t properly monetize and should sell!

Programmatic: This ties into what I was talking about with beehiiv. Look, if you’re a High Yield guy, you’ve heard of Red Ventures, or Internet Brands. They’re Private Equity backed Digital Media Properties that have historically made bank on pretty high CPM, CPA, and CPL advertising - benefitting from really solid SEO from Google. AI changes that dynamic a bit - but there’s another headwind in the space. While sometimes these guys are able to get 100-300 CPM (there’s other B2B media companies that do this too), they’ve seen an increasing mix of programmatic ad spend - aka, the digital buying and selling of digital ad inventory.

The bigger example of programmatic though is connected-TV so the commercials you see on Hulu, YouTube TV, etc. Once you’ve created data-driven profiles of the advertising end-market, automating the process so they’re getting the right ads is highly popular. For YouTube TV in particular, they can a have pretty strong sense of what to show you given your Google, Gemini, and YouTube searches. There’s other buyer and seller markets, with The Trade Desk serving as the largest independent demand based buyer. These CPMs are generally 40-50. I generally think 40-50 is where higher-touch, but lower dollar sponsor offer CPMs should land (and that’s where they seem to land). The hyper-niche, high-ticket stuff is 100-300 CPM, straight up.

If you’re a content publisher you should be very fucking aware that you need to manage your relationships to avoid this. You also shouldn’t taken every deal out there. Like if someone with a big budget or big product is offering a $2 CPC and $5 CPM you should probably tell them to pound sand. But what if that’s actually a fair offer? There’s a reasonable world where newsletters that don’t provide folks with great solutions are going to have those offers and be pretty much a billboard.

Anyone with a niche, sophisticated, smart, wealthy, and engaged audience should avoid the bulk of these pressures but you have to see the writing on the wall here and realize there’s a (ballpark) 30% chance that newsletter ad spend goes mostly programmatic and your $ per volume gets meaningfully hit.

A fully programmatic world would be un-economical though and put most publishers out of business. So while there’s problematic “race to the bottom” features that could play out - it’s hard to imagine a full 100% complete race to the bottom.

Mitigants: In Credit, I always write up “risks & mitigants” sections - so to be fair, there are mitigants here. A lot of advertisers want a very precise audience, so going the ad market route might lead them to some publishers that waste their time and $, and they would’ve been better off paying more to work directly with folks who have the right audience! But still, if there’s a massive shift towards programmatic, then this is a large problem for publishers.

AI Risk: I’m a little conflicted by this. Great writing and routine touchpoints with built-in habits will have people coming back. When we created The Wall Street Rollup, we created it knowing a lot of people are just scanning it and looking for certain things and then moving on with their day. I’m not sure AI can copy that given what unique things people are looking for, and because all it would do is replicate what we’re doing. Where AI probably comes in is 1) as it relates to summarizing lengthier emails and 2) we need a lot less surface-level informational or advice-oriented content - these types of publications are in a bad spot.

Forgettability: I think increasingly the biggest risk in the creator economy is people forgetting about you or moving on with limited friction. If you did not help people, provide value, make them laugh, inform them, establish a relationship, and overall resonate with a large majority of the people following you then you will easily be forgotten. Think about your favorite accounts on X or IG or via a Newsletter who stopped posting. Do you long for them to return? Do you think about them often? If you do think about them it may be very brief and nostalgically. There may be some new creator that has popped up and now you consume more of their content.

This is why I wouldn’t buy an Instagram brand or Newsletter brand that has been static for too long. You have been forgotten, and per the poem Ozymandias, who was the “King of Kings”: “Nothing beside remains. Round the decay Of that colossal Wreck, boundless and bare The lone and level sands stretch far away.”

On that note, lack of voice is a big problem a lot of brands will face - when your publication is led by a brand instead of a person, then you might struggle to connect and run into trouble.

Saturation: The market is packed. The cost to acquire new folks is much higher and folks have already picked their favorite newsletter, maybe don’t need anything, or are exhausted by the category. Going after an industry with already scaled incumbents is tough. In a way, I’m shitting on myself, but I’ll see below I’m full fucking steam ahead.

Mitigant: First, I think if you slip off your game then the saturation stuff cedes opportunity to new folks. I’m a firm believer that a complacent incumbent can always be disrupted! Secondly, I wouldn’t really like trying to compete against me because I’ll happily play a game of Chicken even it leads to a (0,0) outcome. I am the most patient man in the world - like Shawshank Redemption I’ve been picking away at the prison wall trying to get out of my Credit job and into the life I want full-time. I’m going to fight tooth and nail to fight through a crowded market and gain market share.

A Game Theory example of playing Chicken

The Creator Economy could peak in 3 years: This is my hot fucking take. But 2-3 years from now will we need another mid 20s finance professional to come in and say the stuff High Yield Harry, Litquidity, and many others have been talking about? Probably not. Anyone trying to make a meme account today and expecting to get to 200k followers is going to be in for a tough time. My Instagram page itself, has slowed materially in growth and matured in the 147k range and will soon be passed by my X page, which I think will continue to get much larger.

It is very difficult to start today, tomorrow, or two years from now.

“June-Yah!” - Bobby Bacala

Ultimately there are a lot of folks who don’t have the scale or diversification or operates a different type of business model that has a smaller ceiling. There are some “courses” and “coaching” oriented finance creators but I believe high-ticket courses are going to be absolutely wrecked by AI.

There’s an exception for 99th percentile talent, but it’s hard in my eyes to see too many new people taking things by storm. Every new “creator” or business that wants to enter a new vertical, is going to struggle to catchup on the newsletter front, YouTube front, or other types of platforms.

Most people do not have the persistence to succeed in the creator economy: This is the other big thing - the creator economy is a very hard place, in 2023, one singular company made up nearly 33% of my total revenue! And then in 2024, that company decided they were done investing in the creator space! What a hit to the nuts. I have no such concentration anymore, but man, what a risk for a new entrant.

There was a prior writeup called Ad-only newsletters “doomed”

In a Matt McGarry Newsletter Operator piece, he called out ad-only newsletters and said people need to adapt to a “Newsletters 3.0” world. During the initial wave of newsletters, acquisition costs were lower, CPMs were higher, and you could stand out in the inbox easier. The only way to mitigate newsletter ad revenue collapsing, is by selling your own products, have multiple distribution channels, and/or do more marketing services.

I think the problem with trying to mitigate this way though is AI is absolutely eating up educational content and only very niche, reasonably priced paid content from experienced professionals is what is going to survive. When coming up with a paid service, you need to think about why your offering is going to be better than paying ChatGPT $20/month. The other problem is some of these offers include high ticket items and stuff like “coaching” which is prime to disruption and not the most ethical way to make money. While there are mitigation tactics to diversify revenue, I ultimately think scale and understanding there’s an LTV ceiling is the best path to follow.

Tyler Morin, founder of The Water Coolest, which was sold to, and then bought back from Barstool, had a very similar thought.

M&A Overview: Prior Deal Multiples aren’t going to happen again

Exit Opps: The answer is - there probably are no juicy ones. I would say that newsletters at scale are worth $1mm-$10mm. So that is probably the type of exit that very aggressive folks should be looking towards. Obviously, a list of 100k-200k is far from a scaled newsletter though, and probably doesn’t crack a $1-2mm valuation unless it has a high CPM audience.

Generally, non-SaaS media businesses are 1x-5x EV/EBITDA businesses depending on growth rates, scale, and profitability. I might be too negative and maybe LSD is the better ballpark. And obviously, fast growth business models get a much juicer multiple.

Most acquisitions look like an overpay: Listening to the “My First Million” podcast episode with Sam Parr, who sold The Hustle for $28mm, and Morning Brew, which sold for $75mm, was really fascinating. None of them sounded really optimistic about the space. They made their money, and then left. Morning Brew is a massive brand at this point, but it’s public info that revenue has been steady there, it doesn’t sound like revenue has grown. They’ve probably reached their peak from a flagship newsletter TAM standpoint and will try to sell specialist, high CPM newsletters to grow. When your going rates for a newsletter are $40k-60k/edition - it’s a very hard ask to try to sustain that and constantly fill it, even if you have millions of readers.

My issue with Morning Brew has been that a lot of the conversation is too casually wordy in nature, and lacks domain expertise (ie. they havent worked in business or finance). But they are “brand safe” - meaning a lot of blue chip advertisers feel comfortable working with them. What’s interesting about the Morning Brew sale process is Axel Springer was the natural fit, but they tried shopping to other places, such as eTrade and couldn’t get a meeting. And the Founders got laughed at by SoFi (which they didn’t deserve and they proved SoFi wrong after the exit). But look, the fact that these execs are so bearish newsletters post-exiting is not a good thing for the future.

Sure, they grabbed the ladders on the way out, but they believe the growth hacks that they used to have when building these businesses are now gone. They believe CACs are permanently higher and CPMs are permanently lower.

CACs and LTV may be upside down: The cost to acquire newsletter subscribers may be truly be higher the actual LTV of subscribers in some newsletters. This is the hardest pill to swallow and maybe the most important part of my newsletter. If it costs $3 to acquire a subscriber, - so $30,000 for 10,000 subscribers and you’re only making $10,000 in revenue a year, then there’s a big disconnect. Even $30,000 in revenue (which I don’t think is possible with that level of spend is a poor payback period). Generally, I’ve focused on making my money back on acquisition spend within 3-6 months. 6 months is pretty far away so anything beyond that is unacceptable for me and unattractive.

Growing with paid growth to start doesn’t make sense: The reason why the content creators are able to succeed with newsletters is because they’re able to get people to sign up for free. When you lose the ability to get people to sign up for free you are at an inherent disadvantage and maybe shouldn’t even compete.

When I think about the limited tuck-in deals I want to do, it’s for folks who have upside down CACs/LTVs and who blew too much money on paid growth to try to scale up, who then find that the CPM world they thought existed is there for them.

Subscriber churn is rampant: If you’re going to blast stuff into the internet you need to accept that you’re going to have people unfollow you or unsubscribe from you regardless of what you say. That’s life. You need a thick skin. I would generally comp churn to mobile plans or some fiber churn. I’m talking about monthly churn a little over 1% - both from people unsubscribing but because you need to remove inactive emails. So we’re genuinely talking about 15% churn but apparently it’s even higher for a lot of folks. When you compound this over a few years you could run into a some serious retention problems. And the reality is I’m somewhat flying blind here - I have 3+ years of data from the HYH Newsletter, but I have limited data from The Wall Street Rollup to tell me what churn and cohort analysis is going to look like from a 5 year or 10 year standpoint. I’m only going off of industry assumptions. This is a big problem. I just brought up an example where someone adds 10,000 subs for $30,000 - imagine if 15%-20% of them churn! And then imagine ~25%-50% of them aren’t relevant for your newsletter. Makes it potentially tough to spend. This is why, in a way, I think newsletters are more similar to E&Ps than they are to software companies.

Open rates need to be discounted: One can probably approximate that 10 points worth of an open rate are automatic opens. There was a big Apple privacy rule which ruined open rates as an indicator, probably attributing (on our end) 10 points of “automatic opens” where we won’t know whether someone actually read our email. So my 60% open rate could have 10 points (10%) of opens we’re unsure about, making the real open rate 50% at the lowest and high 50%s at the highest.

Co-Registration (“Co-Reg”) doesn’t make sense for serious folks: This is one of my hotter takes since a lot of newsletter publishers do it. It makes ZERO SENSE in my opinion to promote a semi-adjacent newsletter for free. Either get compensated for it or don’t do it. Growth Hacks like co-reg aren’t good ideas and it dilutes your brand and crowds the inbox.

Deliverability reputation matters: Deliverability matters - following best practices is crucial - whether its removing inactive subs, making sure folks can unsub easily, and letting people opt into newsletters.

Consolidation

What beehiiv and these sales did to the Newsletter industry: The democratization of newsletters has resulted in the more winners, but smaller winners. It also has led to a lot of pipedreams from people who don’t fundamentally understand unit economics and don’t have scale.

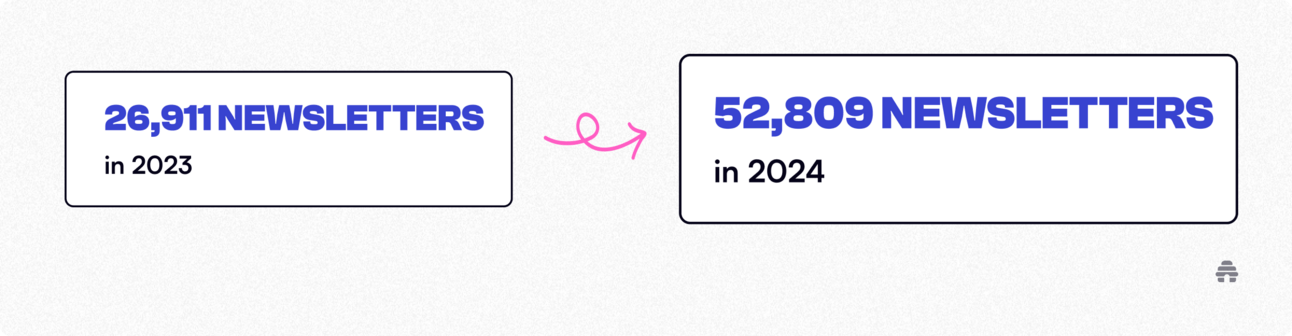

beehiiv gave everyone a toolkit which is amazing, but my eyes popped wide open when I saw that the newsletters on the platform had nearly doubled to 52,000+ newsletters!! That is an insane amount of newsletters. As I write about my concerns in this vertical, I can’t help but think how fucked some of the operators in other verticals might be.

However, I do think there’s room for people like me, and other newsletters to provide liquidity to folks who are looking to exit. That process and best practices will become much more standardized over time - with a lot of off-market deals in the market currently. However, I’ve seen some sub-scale deals go at frothy, laughable levels, so I’ll happily let people chase bad deals and instead focus on adding high quality or derisked subs.

Get Big or Stay Niche is the answer: The answer is to either 1) get big or 2) stay niche. The problem is with staying niche is that if the topic is somewhat static then eventually you run out of things to talk about. That’s why I’m doing both - 1) High Yield Harry’s Newsletter is Niche and Investments focused and 2) The Wall Street Rollup is current events focused, and quite large.

So what’s the solution? There is no solution: The reality is costs to acquire new subscribers are high and ultimately you’re either throwing down to acquire them or you’re sinking or relying on organic growth. Organic growth is possible for elite writers, but eventually that tailwind loses steam.

My acquisition tactics thus far: Over the past year, I’ve been acquired newsletters with 13k-18k readers. This is the range where it’s really hard to scale and you’re stuck in a bit of a tough spot.

My mind has changed on this - I used to view the 5k-15k range as a subscale newsletter, but given all the competition for eyeballs and dollars, I now think for more generalized newsletters, that range is more like <50-60k. On a longer timeline, that might actually be higher and even I might be at risk at 80k subs today.

My acquisition tactics in the future: So what are the 50k-300k subscriber newsletters going to do? They either need to embrace steady declination, sell, or merge/buy someone else. That’s the only way it’s going to go. And I’ve got my eye on these types of opportunities. These aren’t 2025 opportunities, but I try to plan out my business 2-3 years in advance of where I think things are going. Ultimately, I’m going to need to have a conversation on taking someone out or merging forces.

A merger would only make sense if I think I couldn’t maximize sell-in to my products. If I thought the product funnel was weak, then I’d rather focus on making an advertising monolith.

Who is there to exit to? Maybe this is a part to keep closer to the chest. But I’m not sure there’s many folks who would write a big check. One would need to develop best practices that would make a sale more digestible, but as of right now we are structuring The Wall Street Rollup to run into perpetuity.

Why I’m sharing this: Because I’ve done the bulk of the deals I need to do and because I have an unfair advantage as it relates to advertiser relationships and scale.

Secondly, the results from the rollup strategy are robust, but they’re not robust enough for to keep private and hush hush about. I think the strategy is largely done and has fulfilled its purpose outside of some one-off deals.

Lastly, there’s still too much froth in the market - I saw a listing a 3.5x Sales that was quickly put under LOI. This was a subscale asset, mind you. That Buyer is going to be in for a world of hurt if they’re operating it as a standalone.

No Country for Old Men - New Entrants shouldn’t even bother:

I generally think I’ve learned more making $$ from a meme account than I have in Credit. One of my bigger lessons is that URGENCY is all that matters and moving fast and big is all that matters.

There’s some other finance meme/reel accounts that have sprouted up over the past couple years and they’ve absolutely missed the boat on creating a larger newsletter. There’s always room (in every type of medium) for new and unique voices but Newsletters are such a scale and first-mover game.

The Wall Street Rollup has arguably been way behind, but going from not existing to 80k subs in 17 months is a good jump up.

It’s really tough for other Instagram and X Finance accounts who want to monetize though - they’re not going to be able to really play the Newsletter game and that’s a massive revenue stream for a bunch of finance creators. Frankly, this applies to stuff beyond newsletters too.

The Goal for The Wall Street Rollup: The plan with the WSR since the beginning of the year was to get 100k readers, I believe we will hit that (sub here if you haven’t yet) but I don’t have as much appetite to really grow behind the low 100k range (outside of any transformative or accretive deals). The low 100k range feels like a good place from a size of my TAM and from a predictable CF standpoint, and the cost of incremental growth may not be compelling. But man, I wouldn’t want to be solely in the <20k, <50k range at all. Regardless of how sharp your audience is, there’s much significant risk it could all fall apart with a modest change in open rates, deliverability, preferences, AI innovation, and fatigue.

The Future/Success Stories:

The gold standard of the finance newsletter ecosystem IMO is MarketBeat - which is roughly a $45mm revenue business with ~$8mm/year going into Founder and CEO’s Matt Paulson’s pockets. MarketBeat is a very aggressive company that has been growing rapidly for over a decade - emailing millions of users every day and arguably pounding people with emails in a way that could be annoying to some, but ultimately drives conversions and revenue.

Matt Paulson has said something once to the effect of “It’s fine if no one reads this newsletter, all I know is I’m making a lot of money on it.”

And when you’re massive, you can just rapidly outspend everyone else. Matt is so aggressive on ad spend, while still heavily cash-flowing, that it’s arguably impossible to compete with him. The only people that won’t be on Market Beat are those that hate getting spammed constantly - beyond that, they’ll tap into the total TAM and likely double from here.

A lot of 50k-200k reader publications should sell or merge: The problem with merging is everyone in the landscape at that scale is doing the work full-time and has a Type A personality, making a merger of equals situation very hard, and making a next steps pivot hard. So it’s simple - a lot of generalist finance publications need to either accept lower economics, sell out, or beef up. End of discussion. In a way I’m very surprised that consolidation in the 50k-200k range hasn’t played out yet (meanwhile there are a ton of 5k-15k sub range sales), but I think it’s broadly an ego thing.

Here’s another Game Theory framework - although it isn’t this simple because there’s a shit ton of different newsletters and advertising mediums out there.

Yes, time on the internet and email as a medium is growing, but when you look at the newsletter landscape there are hundreds of “price war” chains that exist.

It’s hard to visualize an extrapolation of that game theory framework and not get very bearish. But I feel a lot better writing to actual finance professionals for the most part, with a much smaller mix of “retail”.

Conclusion:

Ultimately, I don’t have a very favorable view on the newsletter industry from a sustainability standpoint. CPMs are going to compress and High CPM providers are at risk seeing their CPMs cut in half (let’s say they’re charging $10,000 for a newsletter - probably gets cut in half to $5,000). I also think people sending 5 emails a week will enter a tough spot as CPMs decline while they’re unable to reduce their weekly newsletter count. That’s why I like having The Wall Street Rollup positioned at 2x/week.

Throughout a lot of this, I provided a very ugly picture for the ability to be able to monetize newsletters with advertisements, but that isn’t really a deterrence for me, because 1) I’m willing to play a game of chicken & to try to consolidate the space, 2) being able to communicate directly with folks (outside of just social media) is paramount to me, and 3) I’m bullish on the new paid plan we have - the WSR Investing Club as a better way to create value for more engaged readers.

In a nutshell, Newsletters to me are increasingly important but in reality it’s primarily a way to communicate with you, with some ancillary stuff attached. My primary focus over the next 7 months is to grow the userbase of Buyside Hub and to provide institutional value with the WSR Investing Club.

Until next time.

-Harry