- High Yield Harry's Newsletter

- Posts

- Private Equity is invading Pet Care

Private Equity is invading Pet Care

Series 1 of our Private Equity Consolidation Deep Dive

This reporting window, skip the manual data work and accelerate your idea generation with a complimentary model from any public issuer in our High Yield & Investment Grade coverage.

Tell us which name you’re focused on and we’ll send you a ready-to-use spreadsheet model, built just as a credit analyst would, complete with FY25 numbers… but unlike other data providers, our datasets are extracted and built via proprietary technology, algorithmically validated against known accounting concepts and enriched with historically reported values - meaning no human error, less reporting gaps and a data set that you can truly rely on.

Why use our data?

Line-by-line models including the 3 main financial statements, debt notes, EBITDA analysis, geographic & segment reporting, operating KPIs & credit metrics.

Every value validated against known accounting and financial relationships

Every model verified by our analysts for unparalleled data integrity

All data sourced from official earnings reports and presentations

Need an up-to-date model for every name you cover? With the Cognitive Credit web app, you can access full credit models and document libraries for nearly 3,000 bond and loan issuers on-demand, alongside a suite of analytical and auditing tools designed to expedite your research.

To see how we can transform your analysis, request a demo today.

I spent several years in Finance. On one side, seeing businesses grow and scale is incredible. Both because as an investor, you’re making a lot of money, but also the employees are along the way as well. But on the other side, during my time, I was disgusted by the men who only sought to reduce headcount or extract value from customers in ways that don’t involve delivering a superior service.

I never covered healthcare, but I always had difficulty with Private Equity’s role in several industries.

In 2026, I’m going to be spending some time looking at PE’s roles in more sensitive industries.

I am not going to be one to criticize everything private equity does. A lot of what they do is geared towards value creation through converting smaller or medium businesses into having the operations and processes to be a larger company that employs more people.

But what a lot of people are worried about is “late stage capitalism” where the lowest hanging fruits have been plucked, and actions to improve financial performance are about decreasing the customer experience to save some bucks, raising prices dramatically, or creating new revenue streams that feel egregious. I generally view “late-stage” as a situation where the premise of free-market capitalism gets broken due to limited competition and anti-competitive dynamics that ultimately exert a poor experience upon consumers and no longer strive towards innovation.

That’s the area we want to focus on, and that’s the area that maybe Private Equity Sponsors and LPs should wonder about being a part of. Healthcare immediately comes to mind, but servicing one’s pets is the area where I think it probably makes sense to start.

Let’s start with Vets:

First and foremost, let me make sure you guys all have access to a resource that will help you know whether your local Vet is PE-backed or not.

Private Equity Vet created their database after their beloved dog paid the ultimate price at a recently acquired KKR-backed practice.

Their dog Pluto was side-swiped by a car, and the severity of his condition and the opportunity to remedy was reportedly missed, resulting in Pluto bleeding internally and suffering cardiac arrest. Despite the limited care, the bill was over $13,000. Upon complaints about Pluto’s mistreatment, an offer of a refund was provided, on the condition of the execution of an NDA. Obviously, Pluto’s owners rejected this.

Following this tragedy, they created a searchable map of 6,000+ Vets in the U.S. believed to be owned by PE or large corporations. A lot of companies will be acquired by Private Equity but keep a lot of the same branding.

Additionally, below is another veterinary practice ownership verification that has a searchable online database for the state of Arizona . It is run by CARE for Pets, see here.

An Overview of the Industry

This has been a really dark piece to research and write up. Pet ownership is a big part of many of our lives, but it is also a costly pursuit. Per Capital One, pet ownership is core for a lot of Americans, with 62.4% of American households owning pets, 66.8% of which own dogs. The avg American pet owner spends $2k+ a year on their pets. This appears to be significantly higher for our generation though - Gen Z (13-28 year olds) are reportedly spending ~$6k on pets annually, while millennials (29 to 44) are spending $5.1k annually on average.

The unfortunate part of the care process too is that folks are increasingly surrendering pets at higher levels, according to the American Society for the Prevention of Cruelty to Animals (ASPCA), the drop-off mix of folks surrendering pets is roughly 29%. But here’s the animal shelter related stats that show how dark the pet care industry is when folks have to give up their pets. All stats are from FY24:

5.8mm dogs and cats entered shelters and rescues, down slightly y/y, with a roughly 50% split between dogs and cats

4.2mm shelter animals were adopted

60% of animals are strays, 29% are surrendered

607k animals were euthanized, down 2% y/y

Euthanasia rates have dropped from 13% in 2019 to 8% in 2024

334k dogs were euthanized and 273k cats were euthanized

The length of dogs, especially larger dogs, staying in shelters has increased over the past 5 years, which is straining shelter capacity

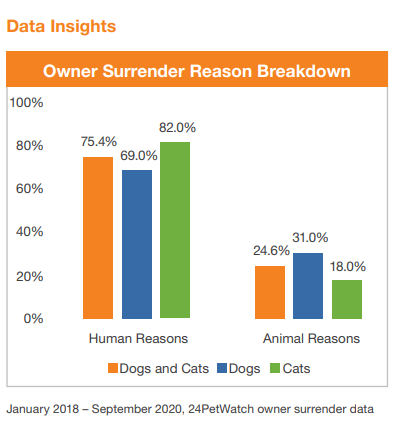

In recessions like 2009, or situations like COVID-19, you have financial constraints rise to high levels like 44.2% of reasons. 61% of shelter intake comes from the bottom 20% of earners, showing that give-ups are primarily an earnings problem. The reasons people give up dogs are as follows:

14.1% of dogs are surrendered due to housing issues

10.1% are surrendered due to the owner’s death

7.8% are surrendered due to aggression

7.2% are surrendered due to the owner’s financial situation

Broadly, it’s due to owner reasons vs. animal specific reasons:

The toll just isn’t on the pet owner either. Per a CDC study, the suicide rate of female veterinarians and male veterinarians is 3.5x and 2.1x higher respectively than the general U.S. population. They have to deal with intense work environments, burnout, extremely emotional circumstances, and higher student debt loads.

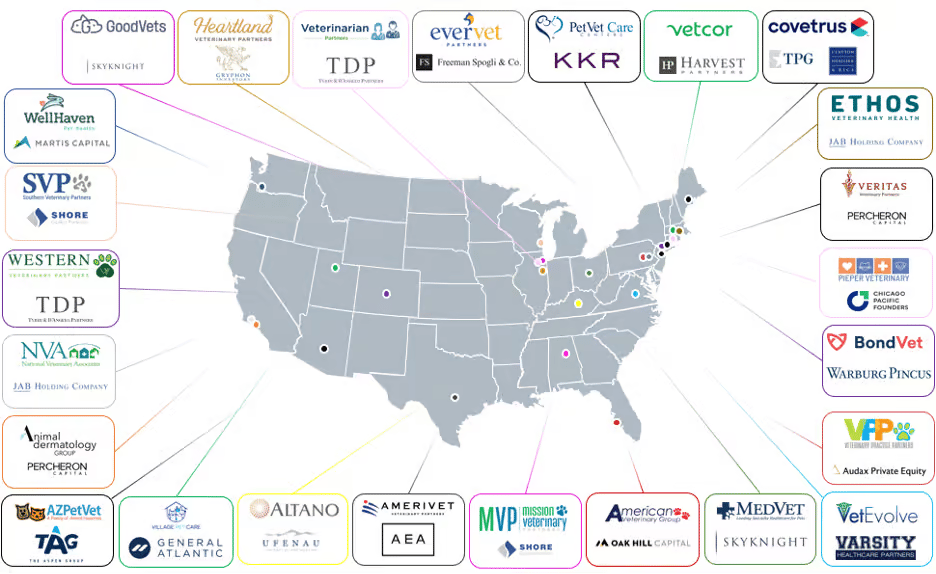

According to KPMG, there are roughly 35k to 40k vet clinics in the US that have rapidly become PE-owned. Per 2023 data, independent vets own 51% of clinics, while large corporations like Mars own 19% of clinics, and PE owns 29% of vet clinics. That 29% number used to be 8% a decade ago.

Private Equity’s role in Pet Care

One of the least enjoyable experiences out there is caring for a pet who is in need of care. This is what I’ve spent a lot of the past year doing, so it hits close to home.

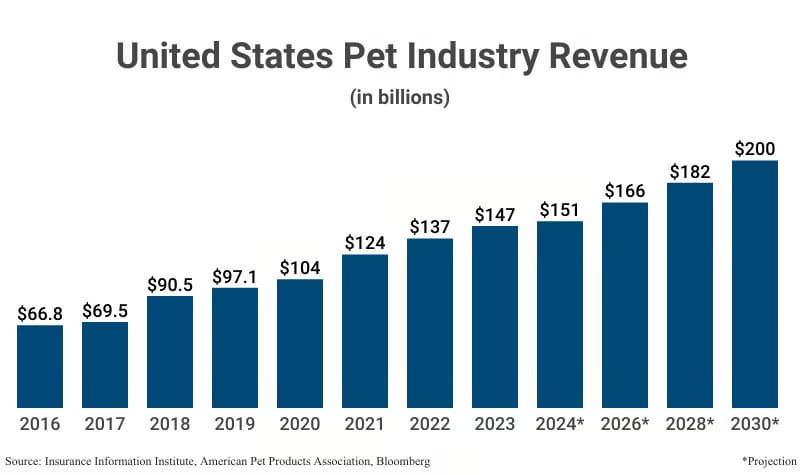

Pets are like a child for a lot of Gen Z and Millennials. And Private Equity has taken notice of how much we’re willing to spend to give our pets good lives. According to PitchBook, there was over $45B in US vet sector deal flow from 2017-2022. This of course has accelerated over the past few years.

The industry was historically quite fragmented and had antiquated marketing, limited marketing expertise, and other business oriented pressures due to doctors being focused on animals; as opposed to being more of an MBA/Business Owner type. While the industry is still quite fragmented, PE reportedly owns 75% of emergency vet hospitals.

“One of the most startling areas of consolidation is in veterinary care. An estimated 25 percent of all general veterinary services are now owned by billionaires and private equity firms, up from 5 percent a decade ago. And the wealth aggregators own an estimated 75 percent of specialty veterinary clinics and hospitals, the most profitable segment of the sector. It is no coincidence that over the last decade, the cost of veterinary care has risen by more than 60 percent, dramatically outpacing inflation. I suspect this is largely due to the impact of private investor consolidation in the sector.”

While the pet industry is massive and usually stays resilient because people treat pets like family, high prices are currently forcing owners to be more selective. This is what Petco in particular is facing - they had a lot of consumers have to shift to cheaper alternatives over the past few years. Petco, which went public, is still majority controlled by its original Sponsor group, CVC and CPPIB. While Petsmart is privately held by Apollo and BC Partners.

Pet retailers have a tougher business model than Vets and other Pet food companies. They’ve survived vs. a lot of other retailers though, as pet stores have been more services focused (grooming, adoptions, trimming, etc.), but there’s a ton of competition from both e-commerce and from other, larger retailers having dedicated pet aisles.

What’s a constant though is as long as there’s pet adoption, there’s going to be veterinary providers to service them. In 2012, there were 13 companies consolidating vet practices, but that number reportedly jumped up to 39 in 2022.

The field was viewed as “low-risk, high-reward,” as a 2022 report issued by Capstone Partners.

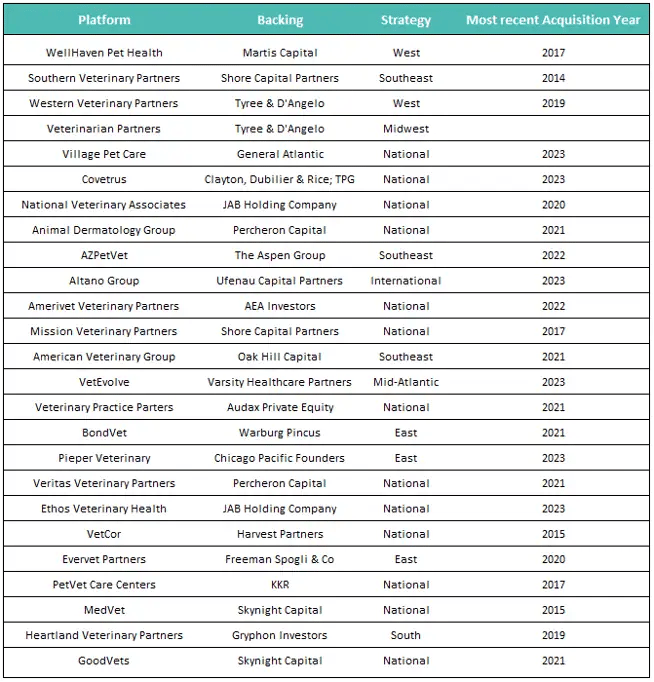

That’s why there’s 20 scaled, PE-backed platforms cited below:

Here’s a rundown on some of the firms in the space:

VetCor: Backed by Harvest Partners and Cressey & Company. They’ve been quite an active consolidator and own over 905 hospitals. The Company has a 2.2 rating on Google reviews.

Thrive Pet Healthcare is owned by TSG Consumer which has 340 general practice, specialty, and emergency vet hospitals, and 115 vet clinics. The reddit threads are pretty scathing.

PetVet Care Centers is owned by KKR and has 420 locations. The Company has a 1.6 rating on Google reviews.

VetEvolve is backed by Varsity Healthcare Partners, and has 30+ clinics.

BondVet is backed by Warburg Pincus, with 50 locations, including 22 in NYC.

Veterinary Practice Partners is owned by Audax Group has 185+ practices.

Western Veterinary Partners has over 250 vet hospitals and is backed by Tyree and D’Angelo Partners.

Inspire Veterinary Partners $IVP ( ▼ 10.53% ) is a hospital group that eventually became distressed.

Mission Pet Health: One PE firm in particular, Shore Capital Partners, has been a key player in the past several years, rolling up hundreds of veterinary clinics through two of its portfolio companies, Southern Veterinary Partners and Mission Veterinary Partners. Together, they own around 850 clinics nationwide, and were merged in December 2024. The combined entity now goes by Mission Pet Health.

Back in 2022, a Shore Capital investor was quoted reinforcing a lot of what we’ve flushed out so far: “I think that what draws private equity investors to this sector is that the industry is very fragmented and presents a great opportunity for consolidation…there’s something like 30,000 veterinary clinics in the country, and around 15% of those are owned by corporate and private-equity backed companies.”

Here’s a look at some more players in the space:

While not “PE” the Mars family and Reimann family (rings a bell as JAB Holding Company) are two family-owned giants that dominate the industry.

The Mars family owns 2,500 pet-care facilities, including Banfield, BluePearl, and VCA, as well as several pet-food companies.

Meanwhile, a portfolio company of JAB’s, National Veterinary Associations (NVA), owns 1,400 clinics and hospitals, owned by the Reimann family. This group generally rolls up local practices and keeps a lot of the same signage. JAB has made tuck-in acquisitions, acquiring Compassion-First Pet Hospitals (specialty/emergency sites) and Ethos Vet Health (145 specialty hospitals), and SAFE Vet Centers (100 hospitals) in multi-billion dollar deals.

JAB was on Lina Khan’s radar, as she previously concluded that due to too much market share, over the next decade, JAB needed to seek approval before buying any more specialty or emergency clinic within 25 miles in the states of California and Texas.

Digging into some of the problems consumers face:

So, cash collection can be great for Vets, but bad for consumers. What bothers me most about this industry is that for many services, payment is due in advance of service AND you’re billed the perceived “maximum” amount. Unlike a lot of your personal healthcare expenses, you may not be billed later. Generally too, you are billed at the highest estimated amount of costs. If the surgery and the associated costs (boarding, treatment, etc.) could cost up to $10,000, then you may be charged $10,000 up front.

These types of clinics will refund you for whatever services they don’t end up doing though, so it may cost $7,000 instead. But the large upfront ask for a lot of Americans is a very tough ask. Especially when a lot of the billing is to diagnose your pet, in advance of any surgery or treatment. Mind you, this isn’t the case for every Vet, but it’s quite common.

Another major problem is that Vets now have to wear a salesperson hat in appointments. What happens unfortunately is that once a firm is acquired by PE, a lot of doctors have to play the role of upselling customers and trying to make at least a certain amount from every appointment and add more patient visits outside of normal business hours. Average client transaction and re-book rates are tracked and there might be a shift towards “production-based pay” where you’re compensated by how much revenue you make.

The Horror Stories:

Unfortunately, I have to talk about some of the horror stories that epitomize the problems at hand. Here’s some of the anecdotes that journalists have reported on over the last few years.

Blanche the bulldog: Stacie Straw, of Long Beach, VA, spent $30k in 2022 for ACL surgery and treating a developing mast cell cancer. Blanche unfortunately passed away several months later.

Boo the rabbit: When Boo the rabbit had liver torsion, the vet at Gulf Coats Veterinary Specialists (“GCVS”), a JAB owned emergency vet hospital, laid out two options - performing a sonogram for $2,500 or keeping Boo under observation for 4-days at $550/night or $1,000 night when given pain meds. The alternative was put Boo to sleep, as euthanasia cost $190. Boo’s owner did not have $2,500 on her credit card, so she felt she had no choice but to say goodbye to Boo. Boo’s family faced a total bill of $1,350 due to the $250 cost for the Vet to see Boo, $550 in initial overnight observation, and Boo’s first series of $360 pain medication. Unfortunately, the cost burden is much higher for dogs, as I’ll explain in this next story that involves GCVS again.

Rocco the dog: 5-month-old Pomeranian puppy, Rocco, weighed 3.2 lbs and upon an MRI, it was found he had hydrocephalus, or too much cerebrospinal fluid. In order to stabilize Rocco’s spine, GCVS said it would cost $20,000. Rocco’s owner took him to a farther, family owned vet instead was charged $9,000 for the surgery. Note, GCVS has disputed the $20,000 price-point as the maximum quote and that the cost of the procedure may have ended up being lower.

Sugar the dog: Sugar was hospitalized for pancreatitis in Pasadena, CA. After 7 days in a pet hospital and a $10,000 bill, she was put to sleep.

Buster the dog: Catherine Liu, a UC Irvine professor, took her elderly pit-bull mix in for treatment after worrying lethargy and excessive drooling. He was treated by VCA, and after $8,000 in costs with sonograms, endoscopies, and evaluation, they were unable to provide any diagnosis. Buster was finally diagnosed with Cancer shortly after, but soon passed away.

Will’s dog: Will’s dog slipped his leash and ran into a car. After receiving $2,000 worth of pain meds, Will had to decline treatment and go to a non-profit vet for treatment. However, that treatment didn’t go well and the pins in the dog’s legs got infected. They raced to an independent pet who removed the pins at a reasonable price. By the end of the ordeal, Will’s bill was $5,000, as his rescue with a distemper didn’t qualify for pet insurance.

Sources for these stories;

Additionally, here’s some Glassdoor, Indeed, and Reddit complaints from Vets

PE’s Side of the Story:

Obviously, these anecdotes are quite dark and you can scavenge the web for more stories. But in order to be fair, I have to give the Private Equity view re: service and inflation. Online in my research, there was a case to be argued that costs are on the rise for a lot of the medicine and goods that are needed to treat pets.

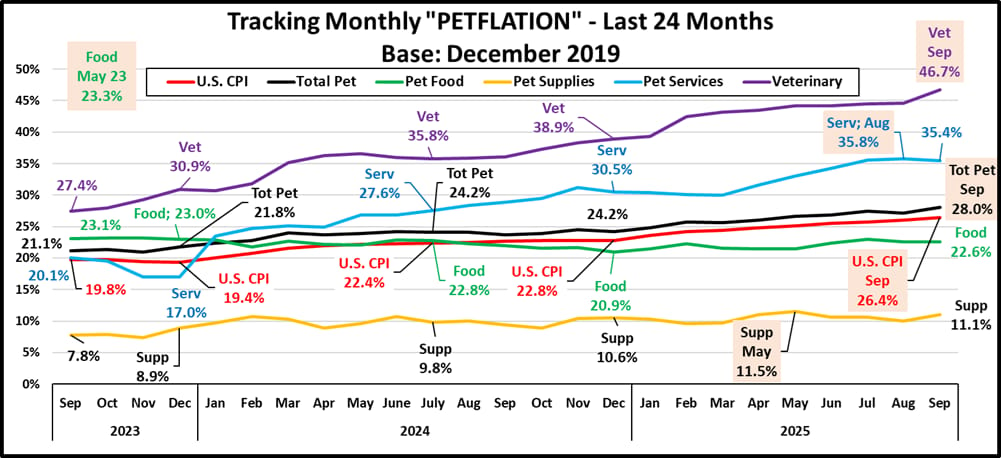

“Petflation” has gone crazy, but how much of that is PE’s fault vs the cost of things rising? Petflation was slightly higher than U.S. CPI and primarily due to Vet prices ballooning, while less critical pet supplies raised pricing at a much lower CAGR.

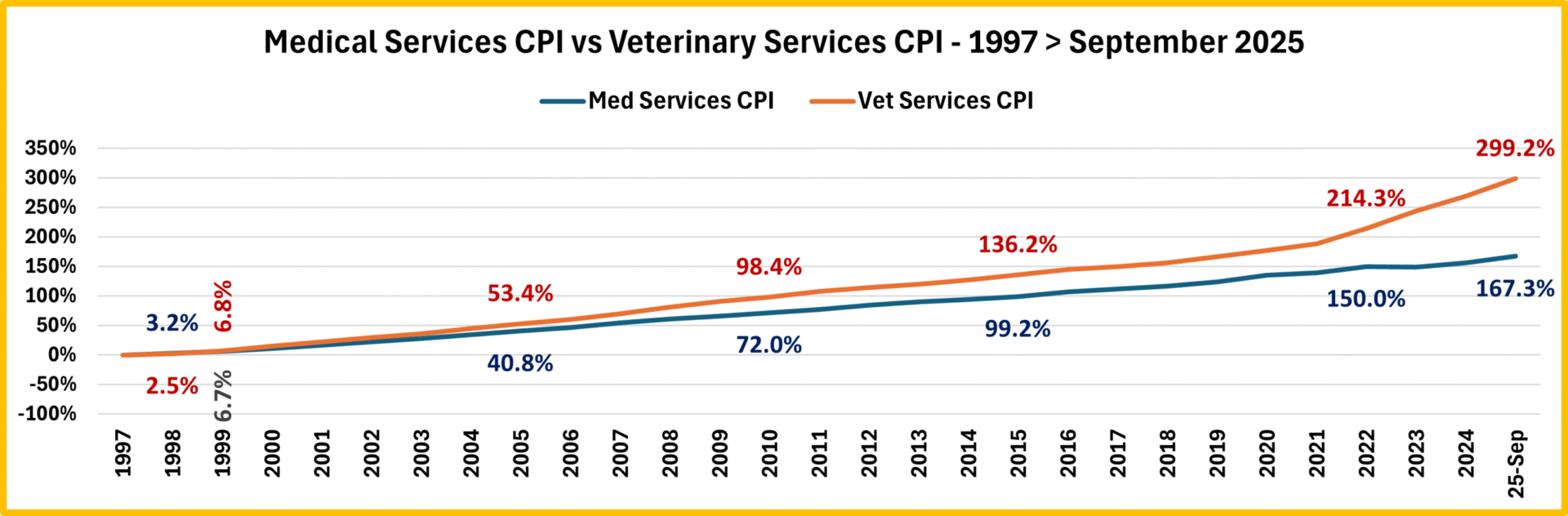

This is crazy though - why is pet vet services CPI so much higher than medical services CPI? Some of that is driven by a switch to domestic produced food in 2007 due to an outbreak, and because of covid-driven supply chain issues, but it’s still quite a resounding rise. Especially as consolidation has rapidly occurred.

Labor costs are on the rise as well, as vet technician compensation has increased.

According to the BLS, Vets were only paid an average of $108.3k in 2020, while Vet Techs were only paid $41.6k/year in 2016, with that number rising to $52k in a 2022 report. The consolidated brands seem able to offer better pay and benefits too. During a response to a letter by Senator Elizabeth Warren, JAB argued that their general practice vets earned $150k/annually, before benefits and distributions, more than the national average of $147k. I mean, it’s great that’s above the average, but calling out $3k more a year as a point to favor PE ownership is hilarious. The distributions part may be fair though, as JAB argued that dividends are ~1% of business value and more dividends go to veterinary practice partners than JAB and investors. Tbh, wages are an extremely important consideration given the average student debt for vet grads in 2022 was $147k.

Mars had also told The Atlantic that “We invest heavily in our associates, hospitals, state-of-the-art equipment, technology, and other resources.”

The other “positives” PE reports too is that once practices sell to PE or Rollups, marketing, software, and other business headaches are now centralized, and vets can return to focusing on their work.

While the better wages and benefits part seems to be validated by a Journal of the American Veterinary Medical Association study, the study generally found that “ability to acquire new large equipment” and the “ability to get new/different drugs” were more of a benefit that independent practices had. AND it reinforced the notion that sponsor and corporate-backed vets pressure folks more towards revenue generation than other centers.

Concluding Remarks: This was a really hard one to write up, as I had to force myself to keep reading stories about people losing their pets over and over again.

What’s really stark about this is that PE seems to prefer buying animal hospitals, as opposed to just regular-way vet services, due to the higher margin profile, high-ticket services, and non-discretionary demand.

From doing a ton of digging, it’s become clear that pet ownership is trending towards becoming a luxury. A lot of folks having to surrender or put down pets are having to do so because of lower income and an inability to pay a large medical bill.

It seems like, in today’s numbers, you have to be ready for the possibility of at least a $6,000 bill when putting a pet down, if not much more. That relates to the costs to diagnose and whether saying goodbye to your friend is the best path for them. So I think if you’re going down the route of pet ownership, you need to confirm that you have the financial means to do what it takes to keep them alive should something serious happen.

For me, I am willing to absorb higher pricing if I have to if it means keeping my boy around. Not everyone has that luxury though. But what worries me too for my situation is whether medium-term profit maximization incentives will worsen overall care quality.

Whether you own a pet or not, this is all quite serious. As investing professionals, you can’t win every deal that comes across your desk, but you do have optionality over what types of deals you play. As we enter a “late-stage capitalism” kind of world in the U.S. I think we have to think about the ramifications of some of the businesses we’re investing in.

The foundation of businesses is generating a profit so you can keep the lights on, but Private Equity’s “raise profits by any means necessary, sell in 5 years” strategy may be detrimental to businesses where human and animal lives are at stake. This series I’m writing is going to keep looking at that question.

Until next time.

-Harry

Upgrade to HYH Premium: Support our writing and get access to my recruiting materials, restructuring writeups, and more. Join Hundreds of Premium readers:

Access Wall Street Comp Data Reports:

Are you getting paid enough? Join Buyside Hub to figure that out.

Buyside Hub has the strongest compensation reports on Wall Street.

Recruit for Investment Banking:

Access the 248 page deep dive you need to recruit for IB. Get started here.