- High Yield Harry's Newsletter

- Posts

- Hearthside - an LBO to Restructuring Case Study

Hearthside - an LBO to Restructuring Case Study

Lessons from the bankruptcy and fall of Hearthside Food Solutions

Hey Guys - a quick Note on Private Credit Jobs: Buyside Hub is helping hire an entry-level/analyst level position at a leading Private Credit manager in Austin, Texas. Additionally, Buyside Hub is helping fill a Senior Associate role in a large Private Credit manger in Boston, MA. Both roles are on the top of the Buyside Hub job board - Learn more and Apply by joining here.

It’s case study time - let’s talk about Hearthside Food Solutions.

At some point this Company came up in a conversation I was having, I think around 2023, but maybe in early 2024. I was either talking about this or a comparable to it to someone deep in the consumer goods space. They brought up how Hearthside was a no brainer pass and it came down simply to customer concentration. All it takes is one customer to back out or reduce volume and then suddenly you have significant issues. It’s risk that was bound to happen, so he argued that he doesn’t do any large customer concentration deals - even if it’s blue chip customers, insurance companies, the government, etc. While there’s some deals with concentration risk that you have to play, in retrospect, this Pass was a good idea as Hearthside eventually filed for bankruptcy in late 2024.

A 2018-vintage LBO, by late 2024, Hearthside filed for Chapter 11 bankruptcy protection in the Southern District of Texas in November of 2024. The RSA outlined a plan to eliminate approximately $1.9B of debt (~2/3 of its debt load) and inject $200mm of new equity capital into the business; additionally supported by a $300mm DIP.

In this piece, we’ll get into what happened to this once, high-flying company.

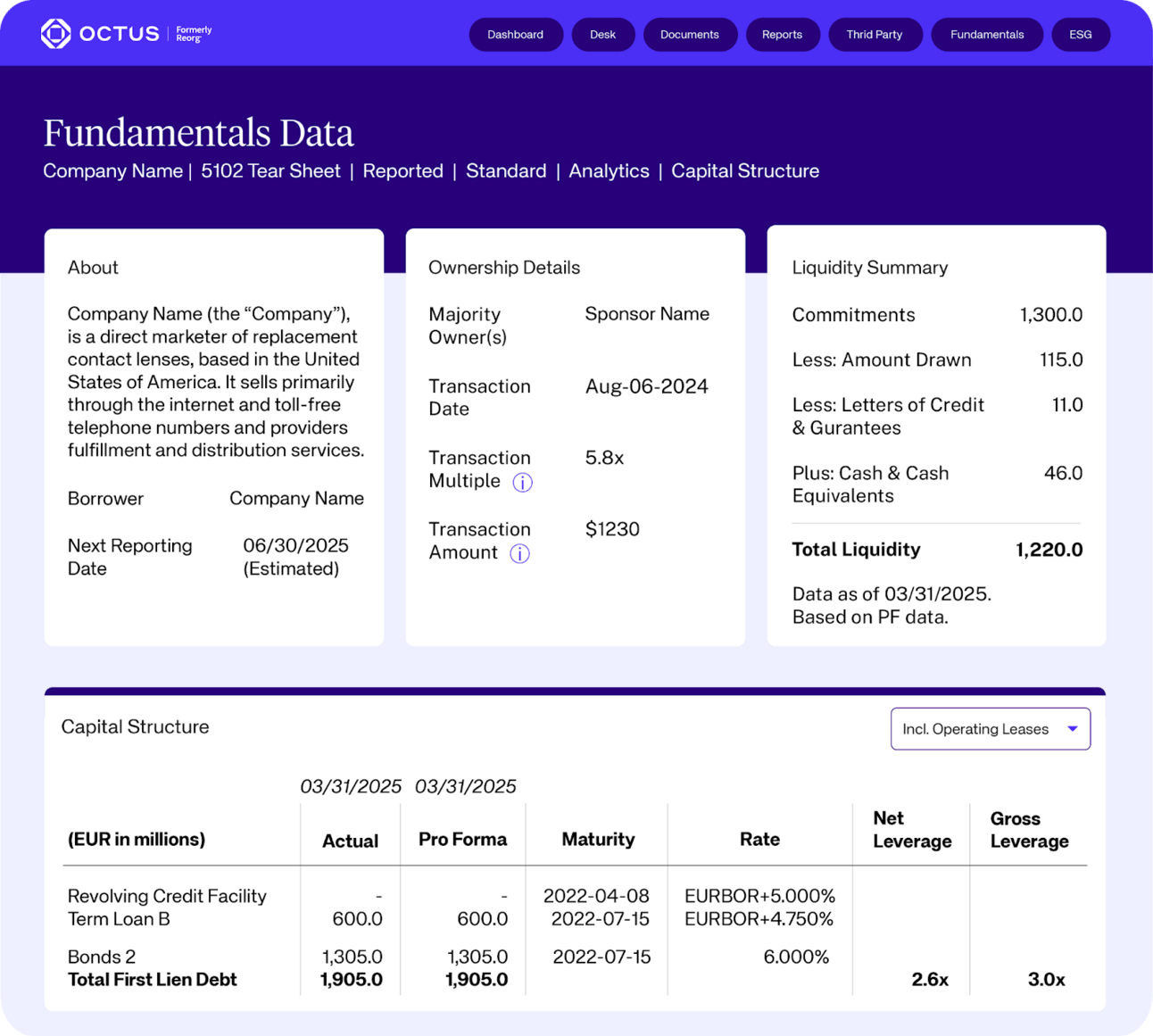

A message from Octus: Welcome to Fundamentals Data, the most comprehensive and in-depth coverage of the leveraged finance market

At Octus, we know how critical timely, actionable data is in dynamic credit markets. That’s why we built Octus Fundamentals to deliver unparalleled insights with the depth and precision today’s professionals demand. Gain instant access to over 3,000 issuers in the US and European leveraged finance market, without the hassle of uploading financial documents, and stay in control with our in-house document management system.

What Octus delivers:

9,000+ transcripts from private company earnings calls, along with bond and loan syndication calls, dating back to 2022.

The sole provider of comprehensive market coverage, including the entire US/EU universe of 3,000+ issuers, including ~1,500 private companies.

Detailed reported and standardized financials including KPIs and segment detail, capital structures, and comprehensive tear sheets for every issuer, accessible via platform, Excel add-in, or API for seamless workflow integration.

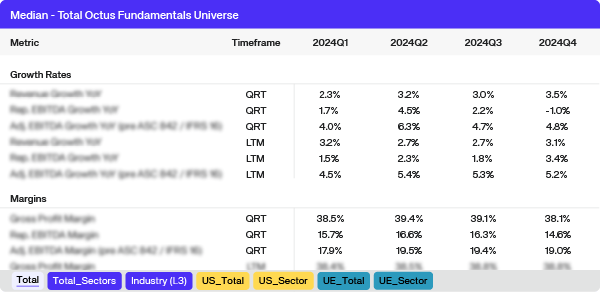

Market data to view trends across the entire US and EU high-yield market—public and private—with first-of-its-kind all-inclusive visibility into how the leveraged finance market is performing.

45 out of the top 50 CLO managers trust Octus Fundamentals. Why don’t you?

🚀 Explore Octus Fundamentals Today and see how it transforms your approach to credit analysis.

The Rise of Hearthside

The First Sponsor Group: Hearthside is a contract baking and co-manufacturing snack provider. We’ll get into more later, but the business grew to include nutrition bars, snack bars, cookies, crackers, and other grain-based food and snacks. Hearthside was originally a carve-out of a few Roskam Baking facilities that was sold to Wind Point Partners in 2009. Rich Scalise, a former Ralcorp and ConAgra executive was brought in as CEO of the Michigan-based maker of snack bar, pretzels, and other snacks. In 2009, it was a mere $145mm revenue business that would rapidly grow through tuck-ins and organic growth. Constitution Capital Partners were also part of the first equity group. In 2010, Hearthside acquired a cereal and granola facility in Oregon and a cookies, crackers, and baked bars maker based in Ohio.

Along the way, Wind Point completed a $400mm Dividend Recap, led by Antares, in 2012. Senior Leverage post the transaction was 3.8x, with 4.7x Total Leverage.

From there, Wind Point merged Hearthside and its other comparable portfolio company, Ryt-Way Industries, together, creating a 19-facility provider that spanned 19 states. By the end of 2013, the Company had grown to a network of 20 facilities and $1B in Sales. Along the way, Hearthside’s Golden Temple unit (a ready-to-eat cereal and granola company) was sold off to Post Holdings, but ultimately this business now had enough scale to be sold to a middle-market private equity firm.

The Second Sponsor Group: In 2014, Goldman Sachs and Vestar Capital Partners acquired Hearthside for a $1.1B valuation. This was a perfect window - rates were low and Hearthside was a compelling roll-up strategy that was rapidly growing. Later that year, Hearthside entered Europe by acquiring VSI, a Netherlands-based nutrition bar producer.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full Access to the Credit Resources Library and all Premium Posts

- • Content that will help get you a job in Credit

- • Content to support Buy Side Investors with their Job Hunts

- • Join Hundreds of Readers Today