- High Yield Harry's Newsletter

- Posts

- Credit's role in the AI Buildout

Credit's role in the AI Buildout

Private Credit is about to get way more involved in the AI buildout

A Message from Octus: Earnings season is here. Get your complimentary model now.

The Q4/FY 2024 earnings season is in full swing, and with it comes the annual slog of chasing down numbers, manually inputting data, and struggling to build meaningful comps. This is the moment your focus should be on analysis and alpha generation, not data aggregation.

Request a complimentary financial model from any public issuer in our coverage and we'll deliver a ready-to-analyze spreadsheet built by our experienced analyst team, complete with the latest reported financials, so you can skip the manual buildout and jump straight into your analysis.

Simply tell us which company you need, and we'll send you a comprehensive model featuring:

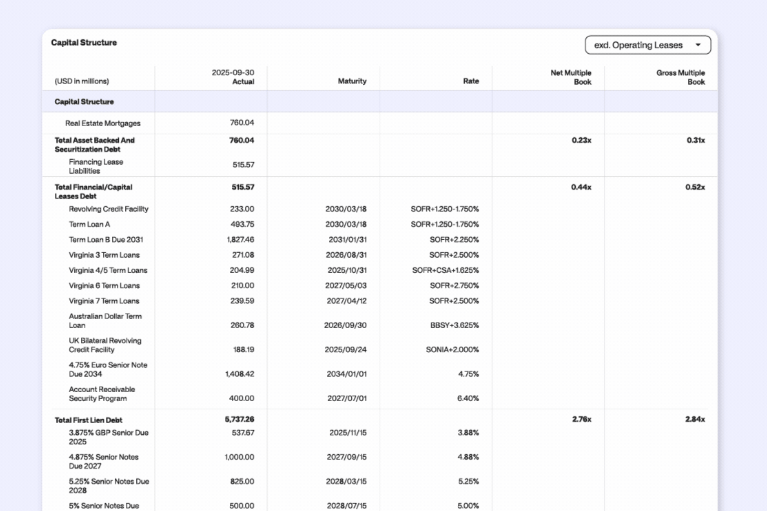

Complex capital structures with detailed debt tables and leverage metrics

Reported and standardized financials for instant comparability

EBITDA reconciliations, segment breakdowns, and company-specific KPIs

Data extracted from official company filings and validated for accuracy

The same methodology, now available for private credit

This complimentary model showcases the exact same rigorous approach we now bring to Private Credit Fundamentals, giving you identical depth and precision across both your public and private credit portfolios. When you subscribe to Private Credit Fundamentals, you gain access to CreditAI. This allows you to layer advanced AI directly on top of your private credit documents and fundamental data, curated by our best in class analyst team. This enables you to query complex private credit data as easily as asking a question.

Evaluate credits consistently across your firm's broadly syndicated, private credit, and private equity deals. Get analysts up to speed faster with the same trusted data foundation, regardless of market.

Welcome back. I’m extremely excited for this piece. I think folks are going to realize that in 2026, the AI story is going to shift away from venture and more into the credit markets.

We are in the stage of AI buildout where companies are starting to rely on the debt financing markets to fund their growth plans. Some of this is coming from IG & HY folks, but private credit is a big chunk of this as well.

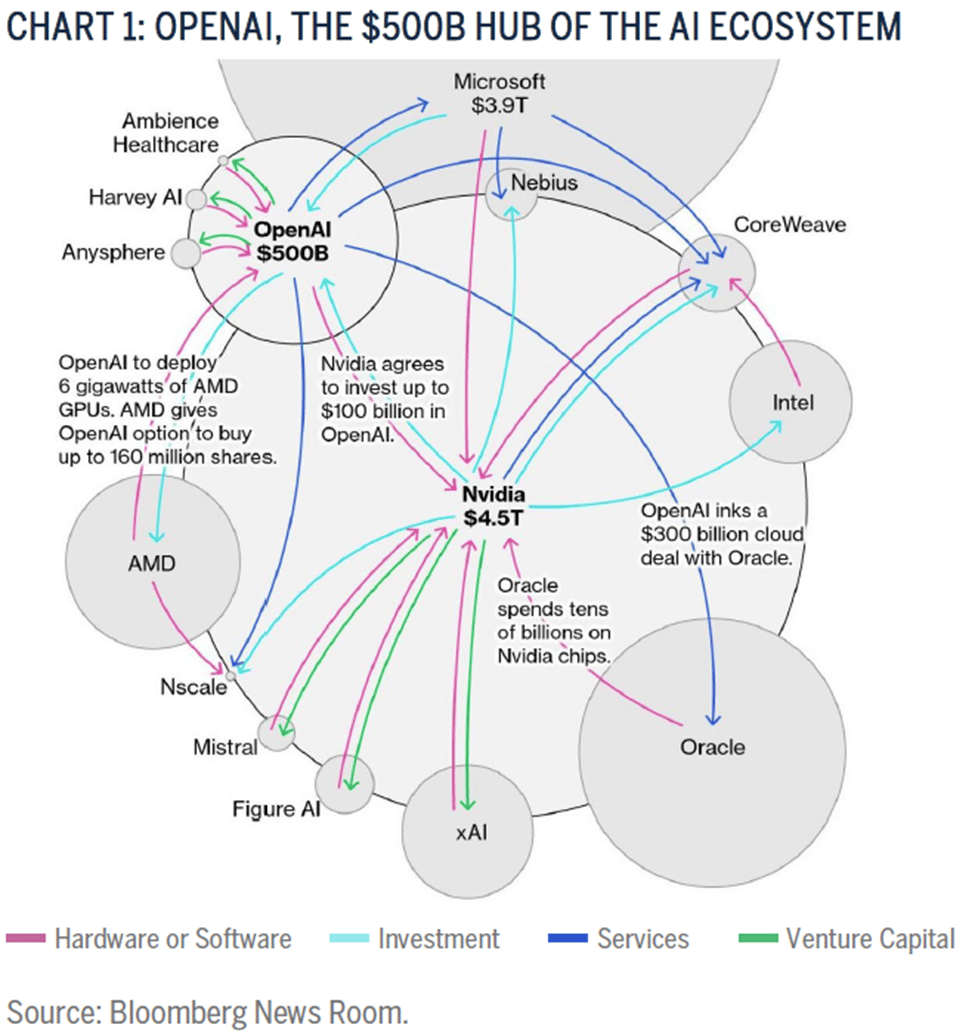

The “Circular Economy” is going to start involving some key financing partners; beyond just the deals OpenAI and Nvidia have been internally structuring.

What is missing in this circular financing chart that has been making the rounds is the fact that the credit markets are taking a massive role in this.

Private Credit has a significant amount of permanent capital and is frankly the best type of capital partner to have for long-term investment projects. Still, a lot of private lending is based on FCF lending and asset coverage, so these deals are based on having a reasonable IRR. This doesn’t mean “non-rated” private credit though - in many cases, we’re talking about IG private credit.

IG Private Credit is driving a large part of AI financing. Oracle is a big spender that’s been under the microscope lately, but the big transaction I’m going to mainly talk about is Meta’s.

Most notably, the view that AI financing is all from strong balance sheets isn’t really the full picture, as SPVs and Private Credit are going to play a crucial role in this market.

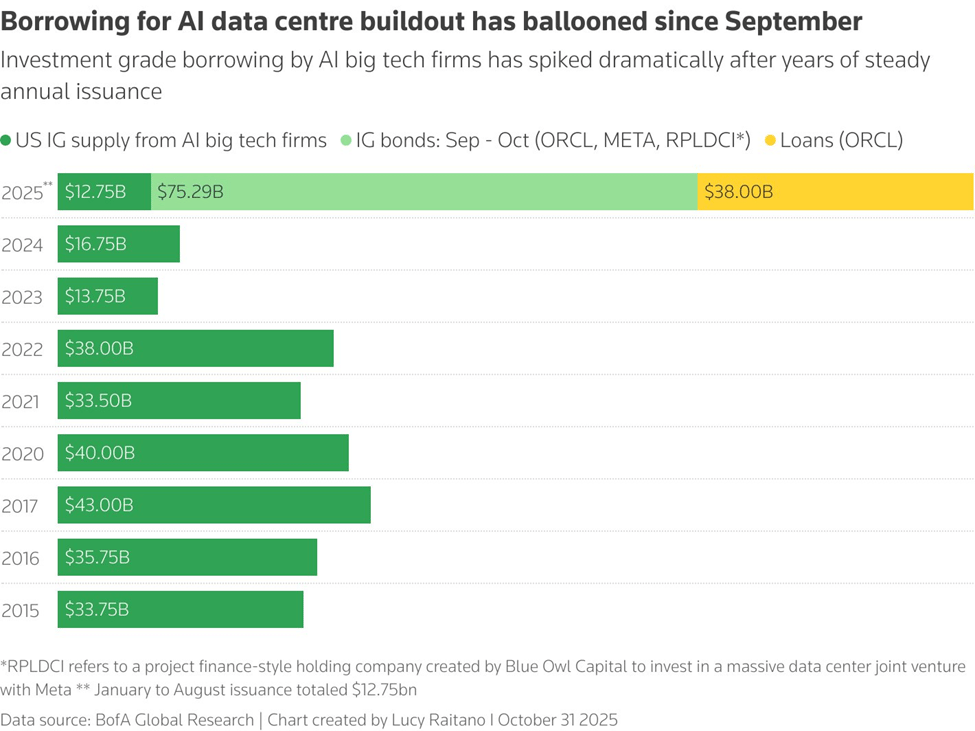

The reality is though, borrowing is expected to grow dramatically quickly (per the two charts below). There was $75B in US IG debt AI-focused big tech companies in September & October of 2025:

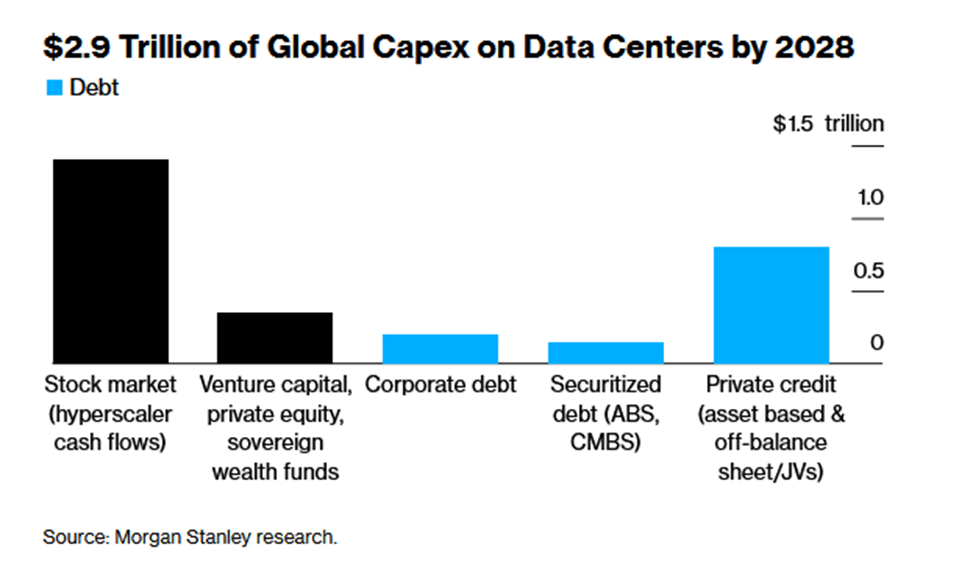

And we’re quite early innings on the quantum of spend that needs to get done. There is projected to be $1-$1.5 Trillion in new debt financed data-center buildout spending by 2028-2030, per projections like Morgan Stanley and JP Morgan, with Private Credit potentially filling ~$800B of that gap. Meanwhile, the BlackRock Investment Institute expects another $5-8 trillion in AI-related capex through 2030. AND S&P estimates that spending on global AI information technology will grow between 28% and 36% annually over the next five years!

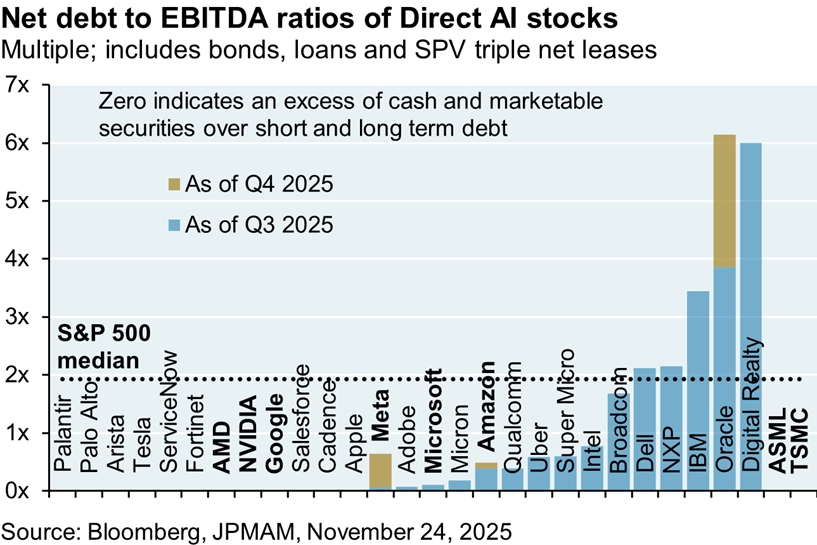

But what we’re here to talk about today is that with these financing transactions, a lot of off-balance sheet risk is being created and leverage profiles are on the rise.

In this piece, we’re going to take a look at the Meta and Oracle projects that are getting a lot of attention.

This has been getting a ton of attention as of late, as collectively, Oracle, Meta, xAI, and CoreWeave have moved $120B of AI infrastructure debt off their balance sheet and into SPVs financed by partners such as PIMCO, BlackRock, Apollo, Blue Owl, and JP Morgan.

Meta’s deal, aka Beignet Investor LLC

There’s a level of incomplete information given the private nature of the transaction, but let’s dig into what we know about this financing.

Meta’s $30B deal for the Hyperion data center in Louisiana was put into an SPV called Beignet Investor, created with Blue Owl Capital. This will be a massive 2.1 GW data center. The vehicle has $27.3B in loans led by PIMCO, with $2.45B in equity from Blue Owl.

Blue Owl holds a 80% stake in the JV while Meta will hold 20% but maintains operational control. Meta will develop, operate, and then become the tenant under these operating leases. To form the JV, Meta contributed the existing data center land and construction assets, with Blue Owl injecting $7B in immediate cash into the entity, with Meta receiving a $3B cash distribution upon closing. The SPV borrowed this $27.3B, to be precise, not Meta. When we think of Beignet Investor LLC, in many ways, we’re really thinking about Blue Owl as the borrower and Meta as the tenant. Meta pays rent, Blue Owl uses the rent to payback creditors.

S&P rated this paper at A+/Stable (only one notch lower than where Meta is rated) with a 6.58% coupon, but quickly traded up to 110, netting PIMCO a tidy return.

But how exactly is this rated at A+? Well, it’s because the ratings are derived from Meta’s contractual lease obligations to the SPV.

Meta will begin paying rent on the data center campus effective June 1st, 2029 and enter five successive 4-year lease terms (20 years in total). While there is optionality for Meta to walk away, which I’ll get into more in a bit, there is a residual value guarantee (“RVG”) that caps the SPV loss should a non-renewal or early termination happen within the first 16 years.

Some other protections include the fact that:

Meta will cover cost overruns above 105% of budget

If construction runs late, Meta is still paying the full rent

Meta can’t terminate the lease during the construction period

Proceeds are invested in treasuries that have maturities aligned with construction milestones - driving amortization and quarterly pay through 2049

As I mentioned, Meta does have the ability to walk away over 4-year increments. But the RVGs are intended to be higher than the outstanding debt over the 20-year lending period. Additionally with the RVG, if Meta decides to terminate the lease and the market value of the data center is less than the guaranteed amount, Meta has to cover that gap.

This is a nice strategic move for Meta though, they’ve raised off-balance sheet financing, are moving fast, still have control over design, construction, & operations, and have 4-year leases they can exit if strategy changes. They’ve ring-fenced project risk in a way and have preserved significant balance-sheet capacity and optionality, with no rating impact whatsoever.

The risks in this profile:

Meta’s obligation to pay for any cost overruns excludes force majeure events

Construction risk is quite real; even with the 105% cap in place, delays in cash flowing are somewhat of a possibility

What if the assumptions underpinning the residual value are wrong? If there’s obsolescence in AI compute, then is someone left holding the bag? Residual value may be extremely hard to predict 10+ years from now. The fair market value is going to be assessed by the project’s independent consultant.

Single asset risk: This is a singular tenant, albeit IG in nature, with one singular campus and one specific power transmission risk (Entergy Louisiana).

SPV dynamics:

These are notes are senior secured obligations of the SPV, which includes all material assets in the issuer structure which are primarily lease revenues and cash accounts controlled through that project-finance like waterfall & amortization schedule.

Via S&P Global Ratings

While the Org Chart is kinda confusing, the reality is somewhat simple: Meta is the tenant, paying the lease under this 20-year (4-year exit) agreement. Meta pays rent, and the SPV uses this to service debt. These are lease liabilities as opposed to corporate borrowings.

What people need to think about though is that while claims are “senior secured” - this is a Holdco - you’re not lending money directly to Meta as someone who will give you Instagram as collateral. And I mean, why would Meta? If they can raise significant AI-related financing at a really low cost of capital without really encumbering themselves, then they’re going to hit that button for as long as they can. So as a Holdco, this is really bankruptcy-remote, and while Meta is responsible for rent obligations and payment obligations, there is a lack of direct security.

Please note that I fundamentally am operating on some incomplete information, given that all the financings and docs aren’t public. Overall, it appears that the Holdco SPV does not have direct access to any corporate assets, this project exists separately from Meta as an entity. The quantum of recourse appears to be over a 4-year lease period and a takeout clause with the RVG. The proceeds of the Holdco aren’t transferred to the landlord SPV via an intercompany so it’s more like an equity position but with debt-like features like a waterfall payment structure. You have an SPV with no claim on assets and likely unsecured claims to Meta. A further problem here is that there could be far too much debt on this asset given aggressive revenue forecasts: With $27.3B in debt and $2.45B equity, the LTV is highly aggressive, and DSCR is low. However, there is natural comfort from the rent payments and RVG, but in an extreme bear case where obsolescence occurs rapidly, Meta would be relatively protected while Lenders would take a hit.

Oracle is the other side of the coin

Oracle has committed to a whopping $248B in data center leases. Oracle’s big deal with OpenAI initially sent the market higher, but now the staggering balls to the wall risk taking, plus the liability mismatch with GPU leasing & rental agreements, has many market participants worried. In many ways, Oracle has been the best way to trade OpenAI sentiment. It’s estimated that OpenAI could account for more than 33% of its revenues by ‘28. Last quarter, Oracle revealed that these $248B in data center leases have 15 to 19 year leases, while there’s a little bit of a mismatch with its $300B OpenAI deal (it’s only a 5-year deal).

Remaining Performance Obligations (“RPOs”) are a massive part of the story here because these backlogs are signed contracts that haven’t been fulfilled yet.

Ratings Agency View: Oracle had its BBB ratings affirmed by S&P back in September, but its outlook was revised to Negative. Meanwhile, Moody’s put out a piece back in December alarmed about Oracle’s growing RPO backlog, which has rose from $68B to $523B in the latest quarter, saying “The increase in contract backlog is impressive, though the counterparty risk and spending and commitments required to support that growth remain significant credit concerns and primary drivers of the rating's negative outlook.”

Let’s take a quick look at their deals:

The Abilene, Texas deal (1.2 gigawatts): This is a JV owned by Blue Owl, Crusoe Energy, and Primary Digital Infrastructure. JP Morgan led the lender group with $7.1B in project financing, with Blue Owl and partners contributing $5B. Additional debt rounded out the $15B expansion, and then Oracle signed a 15-year lease with the associated SPV. The sub-lease element comes from OpenAI in the $300B 5-year deal. Like the Meta deal, the debt is non-recourse to Oracle, but the lenders have security over the 8 data center buildings, the land, and the 400,000 Nvidia GPUs that are part of the campus. Oracle doesn’t have to pay rent until the utilities and data centers are delivered. This debt is priced at S+250.

Schackelford, Texas and Wisconsin: This is another OpenAI oriented project that Oracle is involved in. The financing involves two senior secured facilities, with $23.25B for the Texas facility and $14.75B for the Wisconsin facility. JP Morgan and MUFG led the financings, with participation from Wells Fargo, BNP Paribas, and Goldman Sachs. Vantage Data Centers is the primary developer. These financings are 4-year loans with two 1-year extensions, priced at S+250.

For the $18B New Mexico Project in Dona Ana County, NM, the $18B project is led by 20 banks, with SMBC, MUFG, BNP Paribas, and Goldman Sachs heavily involved. STACK Infrastructure, which is owned by Blue Owl, is the developer, and Blue Owl invested $3B in equity via its digital infrastructure fund.

Are Blue Owl and Oracle beefing or what?

As you saw in our Meta breakdown, Blue Owl is extremely involved in AI infrastructure financing and has $15.4B in digital infrastructure AUM as of 3Q25. Blue Owl was the primary backer for Oracle in the $15 billion site in Abilene, Texas and an $18 billion project in New Mexico.

It was reported that negotiations broke down between Blue Owl Capital and Oracle over the $10B data center project in Michigan. Oracle confirmed that Blue Owl wasn’t in the final financing talks and pushed back on a narrative that Blue Owl may have walked away due to credit risk. It’s unclear who the new partner is, but Oracle has said the project is on schedule and they chose another equity partner that had more competitive terms. Blue Owl may have had more restrictive terms in their term sheet, but given recent noise around both companies, it was broadly received by the market as a form of pullback by Blue Owl. Until the terms are announced and the new partner is revealed, it will be a bit of a “He Said, She Said” game.

Lastly, xAI also had an interesting transaction I’ll briefly touch on: xAI took an approach of raising $20B, with $12.5B of debt within an SPV to buy Nvidia GPUs that are leased back to xAI over 5 years. xAI’s $20B financing has $7.5B in equity, anchored by Valor Equity Partners, and $12.5B in SPV financing. So the debt is secured by the GPUs, instead of xAI corporate assets, keeping it off the balance sheet while the company is burning $1B per month building its Colossus 2 data center in Memphis, TN. The debt financing is backed by companies such as Apollo and Diameter, secured by GPUs and paying ~12%. Where things get circular is the fact that Nvidia, who is obviously a key supplier to xAI, is contributing $2B in equity to the xAI SPV.

The Memphis, TN based Colossus 2 data center

Concluding Remarks:

Capital is ready to rumble. The infrastructure debt market is estimated to be around ~$1T, up 10% y/y, and as we called out, Blue Owl is a major player in the space. Blackstone recently crossed the $100B AUM mark its in its infra and asset-backed credit fund, up nearly 30% y/y. But the risk profile is changing, Palisar Capital was cited as saying, "If we were going to do a junior debt instrument in a data center company two years ago, we could have gotten 12-13 percent, and now you’re lucky to get 9 percent and you’re taking similar risks." If the risk premium to lend these capital intensive assets compresses, then I think that’s where Investors and LPs will run into the most trouble.

Private Credit gets a lot of noise, especially following the First Brands debacle. But in many ways, defaults in Private Credit are “a feature” not a bug. There’s no way to get around the fact that leveraged lending increases the probability of defaults! You can gain large followings on X by claiming Private Credit is a bubble, but you can’t fall for “anec-data” where you let a low number of datapoints presented as significant headlines override the reality that a lot of private credit deals are performing quite well. What’s striking about private credit too is that a lot of the deals are “IG private placements” where large institutions with durable capital bases are able to make term commitments at rates and terms that are more appealing than what a bank or a group of smaller, less sophisticated corporate borrowers could do. Especially those that lack organic, insurance related funding.

Private Credit is going to be about “the big getting bigger” and I don’t think we’re late innings on players like Apollo, PIMCO, BlackRock, KKR, Blackstone, and many others who can write massive checks getting materially bigger.

The reality is these durable capital bases are the perfect fit for this new technological revolution we’re facing. Like every creditor, they will probably want to diversify their projects and their borrowers, but a lot of the growth in private credit over the past decade has quietly come from project-finance related projects. Think about LNG exporters. A lot of these plants and strategies fundamentally didn’t exist and required project debt related financing to get done. Many people compare AI to railroad buildouts, but it’s corollary to the shale boom as well. What worries me about the AI boom is when people run out of money, and for me, that’s when the bulk of lenders suddenly shy away or become very restrictive.

The risk here is that yes, even though these are IG borrowers, there are some real worries about what type of recourse lenders could have if things go astray, especially given the fact that the claim is ultimately on the SPV. The fear a bear would worry about, is whether RVGs become materially worse than expected due to obsolescence, if lenders pull back, or if there’s a systemic shock related to OpenAI or someone else.

Until next time.

Recruiting for a seat in Credit? Leverage HYH Premium to access our full resources of credit recruiting materials.

Access to our research reports on stories such as the Brooklyn Mirage and Forever 21 are a part of our paid library.

We have monthly and annual plans depending on your needs.

Access Wall Street Comp Data Reports:

Are you getting paid enough? Join Buyside Hub to figure that out.

Buyside Hub has the strongest compensation reports on Wall Street.

Come hang out on South Beach:

I’m spending part of this winter in Miami. If you’re in town for the JP Morgan Leveraged Finance Conference on Sunday, March 1st, lmk. Small group and generally for credit professionals but email for potential access.

Disclaimer: Obviously none of this is financial advice and you should not take make any financial decisions based on what was included in this piece. This publication is for informational and educational purposes only and should not be construed as investment, legal, tax, or financial advice. We are not registered investment advisers or broker-dealers, and this newsletter is distributed under the “publisher’s exclusion” of the Investment Advisers Act of 1940. The content provided is impersonal and general in nature; it does not take into account your individual objectives, financial situation, or needs. Investing in securities involves risk, including the possible loss of principal, and past performance is not indicative of future results. You should consult with a qualified financial professional before making any investment decisions.