- High Yield Harry's Newsletter

- Posts

- Building Wall Street's Premier Compensation Hub and Job Board.

Building Wall Street's Premier Compensation Hub and Job Board.

High Yield and Credit Job Postings, plus our July Update and 5 Years of High Yield Harry

"Your margin is my opportunity" is probably one of the hardest quotes of all time.

— High Yield Harry (@HighyieldHarry)

4:06 PM • Jun 26, 2025

Welcome back!

We did a Buyside Hub update a while back and it’s time for another brief update today.

I was thinking about doing quarterly Buyside Hub updates on this newsletter, but it seems like once every other month is a better cadence. But I wanted to highlight two roles we’re helping find candidates for plus highlight that we’re kicking off our Investment Banking & Sell Side Compensation Report for everyone on a summer bonus cycle.

I also want to do a broader HYH Update, because shockingly enough, July 5th marks the 5-year anniversary of the start of the High Yield Harry brand.

On the future newsletter side, we have a lot of research-oriented content coming across in July and August, so stay tuned.

We have two dedicated postings - for Minnesota and Boston professionals. If these roles aren’t for you, call up your friends who live there and let’s get more investment professionals hired.

We’re filling a Senior High Yield Analyst role based in Minneapolis, Minnesota - learn more here

We’re filling a Director role within the Barings Portfolio Finance group, based in Boston, MA. Learn more here

I created Buyside Hub to provide you all with the most robust compensation analytics and firm culture insights platform on Wall Street - as well as to get job opportunities to as many of you guys as humanly possible. I believe we’re starting to execute materially on the job opportunities side of the house.

The “Need To Exist” Test has been validated

In Credit, there’s a holy grail test when evaluating a new business to lend money to - it’s the “does this business need to exist” question.

I knew this was the case as a Buyside professional trying to figure out what I should be paid and what the culture of the Funds I was interviewing at was like. And it seemed like a no-brainer to me that I could leverage my distribution to make hiring more frictionless.

But now, it’s become clear to me that we’re executing and delivering significant for Enterprises hiring.

What’s different from the update email I sent a couple months ago, is we’ve clearly delivered and the value prop is there.

Still, it’s not the most glamorous work for the team. Myself and the people that work with me are hustling and working like dogs, and there’s so much we want to do, but are confined by time constraints. And like most startups, there’s obvious financial constraints. It is very hard, I wouldn’t recommend it - but it’s a cause I’m passionate about. But we’re working hard and we’re mission driven.

In the Tech world, you’re either a Missionary or Mercenary. A Mercenary is a soldier who fights for a country, group, or cause due to monetary gain, as opposed to ideological reasons. During my career in Finance, I have been a mercenary - motivated by what maximizes my financial outcome. Meanwhile, a Missionary is someone dedicated to a religious mission and cause. In the Tech world, you want to avoid working with mercenaries and work instead with people are passionate and dedicated to the cause.

Buyside Hub is a very mission driven company. I know all the exact pain points with recruiting and in working with Finance.

Ultimately, I want my platform to be a go-to for 1) Going through Compensation Data and 2) Trying to find Finance Jobs. You guys ask me about esoteric comp datapoints and about different types of careers all the time, so this platform is here to solve that.

That’s why I’m so fired up about the fact that as a 5-month old company we are executing on getting users interviews and driving hiring solutions.

I’m excited to keep working with Companies in order to get more roles out there for you guys - which leads me into the next part of my newsletter.

So to follow up on the last Buyside Hub update re: “willing things into existence”, the early indication is that we are going to provide the exact amount of value that was initially envisioned.

Introducing Buyside Hub’s Enterprise Suite

We’re excited to introduce Buyside Hub’s Enterprise Suite - the destination for hiring managers to learn more about why recruiting on Buyside Hub is a no-brainer.

You guys are users who I’m sure can see the value as an employee - but let’s look at the other side of the coin - there’s a ton of value from the perspective of an employer as well - particularly as it relates to finding people to hire.

And the Results so far speak for themselves - look at what Buyside firms are saying about Buyside Hub so far 👇️

Our goal is for you guys to ditch the pricey recruiters and leverage our massive distribution network instead.

Investment Banking Compensation Reports & Intern Data

I’m a straight shooter - I don’t really care about Intern data - and I don’t care that much about Investment Banking Analyst data - it’s partially because those days are long behind me, but it’s also because Investment Banking and the Sell-Side is a small part of most Finance careers.

Most finance people spend 1-3 years in Banking or on the Sell-Side and then go off to join the Buyside.

We’re Buyside Hub because what people are actually trying to figure out is what Buyside compensation looks like the farther you get along, especially as it relates to deferred compensation.

But early on, we want to solve for seasonal compensation questions and build some familiarity with the app. And we also think Investment Banking VP and up compensation is very interesting, with a lot of Banking MDs contributing to the site to learn more about compensation benchmarking.

So if you’re an Investment Banker or are part of the Sell-Side, we’ll give you a month free if you contribute your compensation data and culture insights. Investment Banking Compensation Data drops in July and August, so we’ll put together a detailed report on our findings that we’ll share.

🔴 So Investment Bankers - make sure you sign up so you can contribute to the survey and then access our Investment Banking Compensation Survey 🔴

Obviously more than just the Private Equity, Private Credit, Hedge Fund, and Asset Management Pros are welcome:

I’ve noticed an uptick in venture capital compensation data starting to flow in - they’re definitely welcome to contribute, as are the folks in corporate development, which in a way in a “buyside” role a lot of folks contemplate after some time in traditional finance.

Just remember Buysiders, in order to get the full 12 months, you also need to provide firm culture insights and make it easy for our team to verify. We’ve dinged people 2-3 months of free access if they’ve added friction in the verification process.

As I said in my last update, Buyside Hub by design is a platform that gets better every time a new user comes on and contributes data and firm insights, and every time a new applicant applies to a job on Buyside Hub and has a successful outcome or a good interview. This is a highly niche platform, but the more people that sign up the bigger snowball this becomes.

As always, I’d like to hear from you: Please feel free to reply and our contact email is [email protected] - you can reach us from there anytime.

So before we move onto the next part of the newsletter, make sure you sign up below for the fastest-growing job board on Wall Street today.

Five Years of High Yield Harry

I can’t believe it - there’s no way it’s been almost five years. So much has changed in the world and in my life.

The one thing that’s been ever-present over the past five years is that 1) more things are moving towards tech/turning digital and 2) any “too good to be true” excesses don’t last forever. Yeah, yeah, I know there’s periods of irrational exuberance and people making generational wealth in stupid ways (especially this month) - but the “stupid” opportunity always changes and the window always closes.

Next week is the 5 year mark of the me creating the High Yield Harry accounts.

A lot has changed online and in life in that time.

I started the account as an Analyst, can do the math on where I’m at now.

A lot of accounts have come and gone, but I’m so in love with the

— High Yield Harry (@HighyieldHarry)

7:38 PM • Jun 28, 2025

I’m a “always buy stocks” guy but my biggest regrets are not buying more risk, particularly getting too cautious on crypto post the FTX fallout, trimming stocks like Palantir too quickly, and not recognizing what was happening in AI fast enough and reflecting that in size.

So yeah, I know stocks are at all-time highs, so it’s not financial advice around that, but if my biggest piece of advice from the past five years is to take more risk, but there’s probably something you can extrapolate from that.

More Advice: Btw - I wrote these materials for college students a couple years ago - here’s my Networking Advice and Planning for your career on Wall Street pieces for anyone newer to the newsletter (and younger) who needs it. It’s unreal how much has changed since I was a college student and I would’ve loved getting this advice 10 years ago.

I included it in that tweet above, but when you’re posting content to the internet you will get a ton of positive and negative noise. The positive noise is great, constructive thoughts are also amazing, and the negative noise you have to block out or eat up. Ultimately, all I care about is executing and staying the course.

Execution, execution, execution: This is my favorite word - really you just have to do things effectively, everything else is just noise. Theories, Philosophy, Hypotheticals, Intellectual Debates, etc - all are worthless compared to just doing something & executing. That’s why I prefer Doing over excessive Reading & Studying. Sometimes you’re stuck with some paper-pusher type tasks you have to deal with, but in investing and business building roles, you’re focused on execution every day - anything that drives the business forward is nobler than unsustainable, paper-pushing cushiness.

I’m very zoned in on executing on my newsletters (this one and Wall Street Rollup) and with Buyside Hub. I obviously have other offerings, including our Banking Playbook offering which is designed for future Investment Bankers recruiting for IB roles, and my Autopilot portfolio strategies, where you can invest alongside me in different strategies focused on “my best ideas”, private credit asset managers, cash-flow cows, and American reindustrialization beneficiaries. I have $558k in “AUM” as of writing and enjoy managing the Autopilot copy-trading strategies.

These are my core revenue streams, but I’m always looking for synergistic ways to provide value to folks - so I’m open to any more ideas that fit within this ecosystem.

Like I said about Buyside Hub earlier in this piece, it’s very hard, but this is something I’m passionate about and care a lot about.

I’m a big believer in “In order for me to win, everyone else needs to win first”. That will continue. But there’s more to things than just that, it’s about doing right by you guys, and thinking how I can leverage my distribution to provide value.

I’m going to use Nathan Fielder, the comedian writer behind Nathan For You and The Rehearsal as an example.

I think what Nathan Fielder was able to do in the past season of the Rehearsal was really important. Sure, he’s running a tv show and making money from that, but he dedicated years into trying to draw awareness into the problems he’s seen in aviation crashes.

The comedian trained as a pilot in his pursuit to create improvements in captain and first officer communication, as well as in pilot mental health. Fielder wants more role-playing training that will help pilots not be afraid of speaking up in the cockpit.

You can laugh off Fielder’s efforts due to his track record as a comedian, or you can appreciate what he was trying to do (I certainly do). We’ve had a ton of scary events in American aviation as of late, so any efforts to save even one human life is something I’m going to appreciate. Not only that, but Nathan didn’t have to make Season 2 of The Rehearsal about aviation safety - he elected to leverage his massive HBO budget and large audience to go after this cause.

Right now my idea is “I have a massive fucking platform, and I have a bunch of people tuned in looking for jobs. I’m going to shoot out as many relevant jobs to folks as humanly possible, it’s the least I can do for everyone.” There will be even more impactful things I’m able to do in the future. I’m not sure what exactly that looks like, but we’ll figure it out.

Until next time.

-Harry

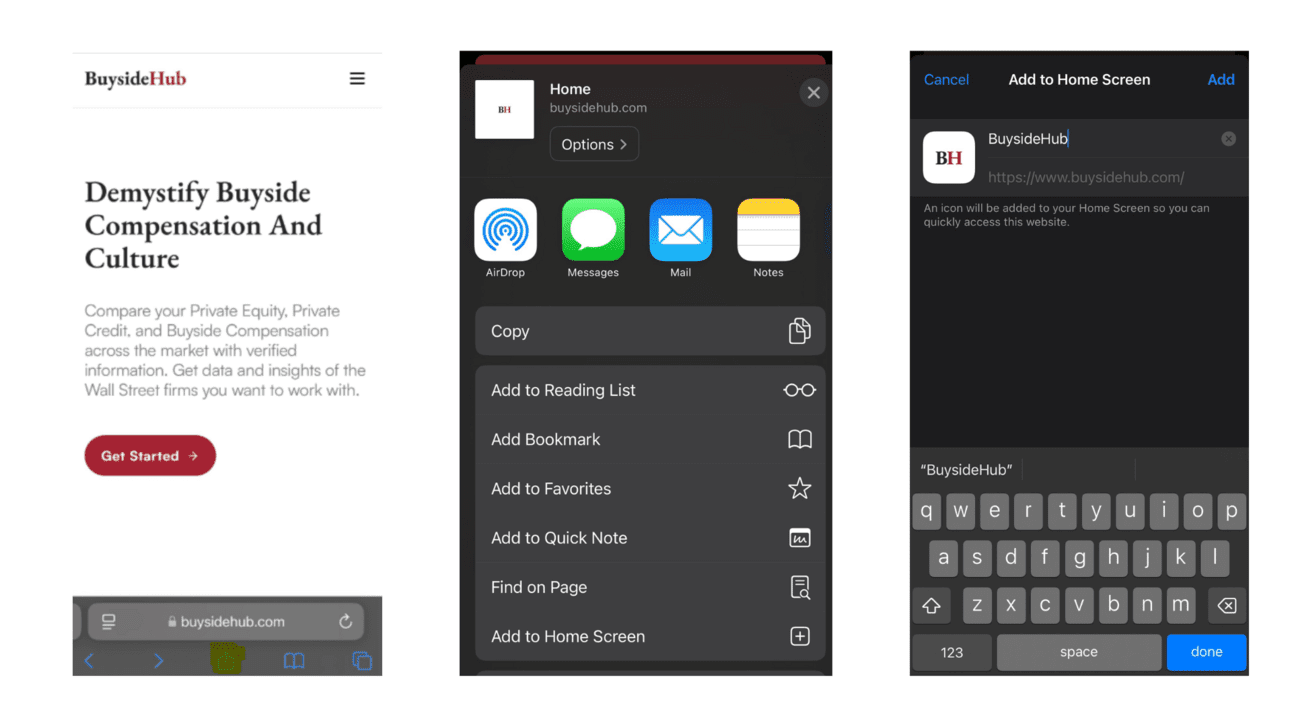

How to download Buyside Hub to your phone (without the app store):

Access the website link in the browser and click the share button (I highlighted)

Click the Add to Home Screen Button

Click “Add” and boom! You now have the Buyside Hub App!

In Other News:

Learn more about HYH Premium, my Credit and Investing Resources that you can leverage in order to recruit for Buyside Credit Seats.

Autopilot disclosure: Investment advice provided by Autopilot Advisers, LLC (“Autopilot”), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.